The TIS INTEC Group at a Glance

The TIS INTEC Group at a Glance

Provider of comprehensive IT services to corporate clients.

Have secured top-class position in domestic market as largest independent contractor.

Three Strengths of the TIS INTEC Group

-

Solid management platform

TIS'solid management platform comprises three building blocks—a broad client base, an extensive business base and a stable financial base—which provides the leverage to drive business forward and underpins good financial health and capital efficiency. -

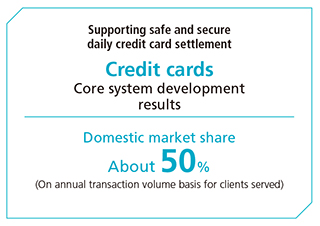

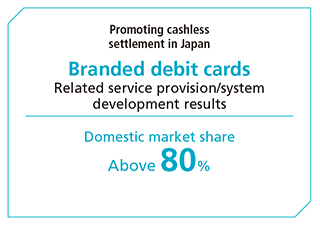

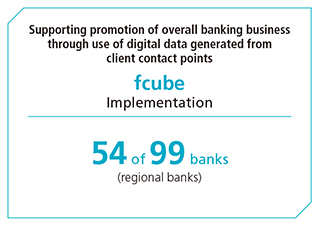

Dominant presence in payment services domain

TIS has cemented its position as a leading system integrator in the domestic payment services domain.

Drawing on capabilities accumulated through SI activities, we are quickly rolling out service-style operations matched to technological innovation and diversifying payment methods. -

Flexible management strategies and speedy decision-making thanks to independent status

The TIS INTEC Group established itself as the top of Japan's IT services industry as a major, independent corporate group free from keiretsu ties. The absence of a controlling shareholder ensures management independence facilitates decisions that leverage robust, flexible and speedy business development of Group operations.

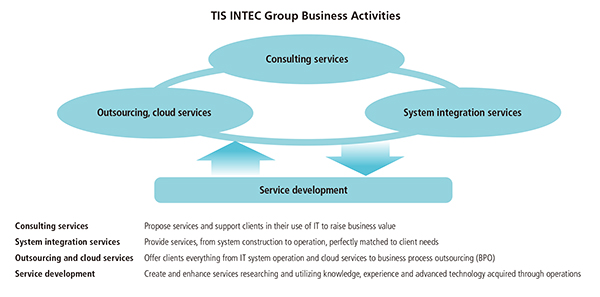

TIS INTEC Group Business Activities

As an IT specialist that partners with clients, the Group handles a wide range of IT services and provides optimal one-stop support.

The Group's IT services supports society in ways some may take for granted, and contributes to meeting social needs through its business.

Examples of IT services in the TIS INTEC Group portfolio that help support clients' businesses, the lifestyles of individuals and social infrastructure

* For details, please go to "Integrated Report 2024" page 16.

TIS INTEC Group by the Numbers

Main consolidated subsidiaries

| TIS and main group companies | Shareholding ratio | Description of Business | Fiscal 2024, ended March 31, 2024 (Millions of yen, non-consolidated basis) |

|

|---|---|---|---|---|

| Net sales | Operating income (operating margin) |

|||

| TIS Inc. (operating holding company) |

— | Focuses on credit card companies but pursues business opportunities in a wide range of sectors, including services and manufacturing. Promote to expand payment business. Merged with pure holding company IT Holdings Corporation in July 2016 and became operating holding company. (Incorporated April 1971) | 251,334 | 32,025 (12.7%) |

| INTEC Inc. | TIS 100% | Focuses on megabanks and life insurers, and assists with CRM for regional banks and offers a wide selection of services to regional public corporations, particularly in the Hokuriku region. (Established January 1964) | 122,234 | 12,087 (9.9%) |

| AGREX INC. | TIS 100% | Leading company in BPO sector, with emphasis on insurance industry needs. Turned into a wholly owned subsidiary in March 2015, becoming core company for BPO business within the Group. (Established September 1965) | 37,185 | 3,792 (10.2%) |

| QUALICA Inc. | TIS 80% Komatsu 20% |

Formerly, information systems subsidiary of Komatsu. Focuses on assemblybased manufacturers, mainly those under the Komatsu Group umbrella, while expanding business with companies in the distribution and restaurant sectors. (Established November 1982) | 26,534 | 3,210 (12.1%) |

| AJS Inc. | TIS 51% Asahi Kasei 49% |

Formerly, information systems subsidiary of Asahi Kasei. Focuses on companies under the Asahi Kasei Group umbrella. (Established March 1987) | 18,662 | 2,257 (12.1%) |

| MFEC Public Company Limited |

TIS 49% (based on control criteria) |

Thai-listed, leading provider of enterprise IT solutions, which has strength in banking, communication, and governments. 9 subsidiaries under the company. (Established March 1997) |

*

30,670 |

*

3,217 (10.5%) |

* MFEC Group, consolidated basis (fiscal year ended December 31, 2023). Numerical values based on accounting standards in home country of Thailand using rate prevailing at end of fiscal year.

For other group companies, please refer to "TIS INTEC Group Companies"

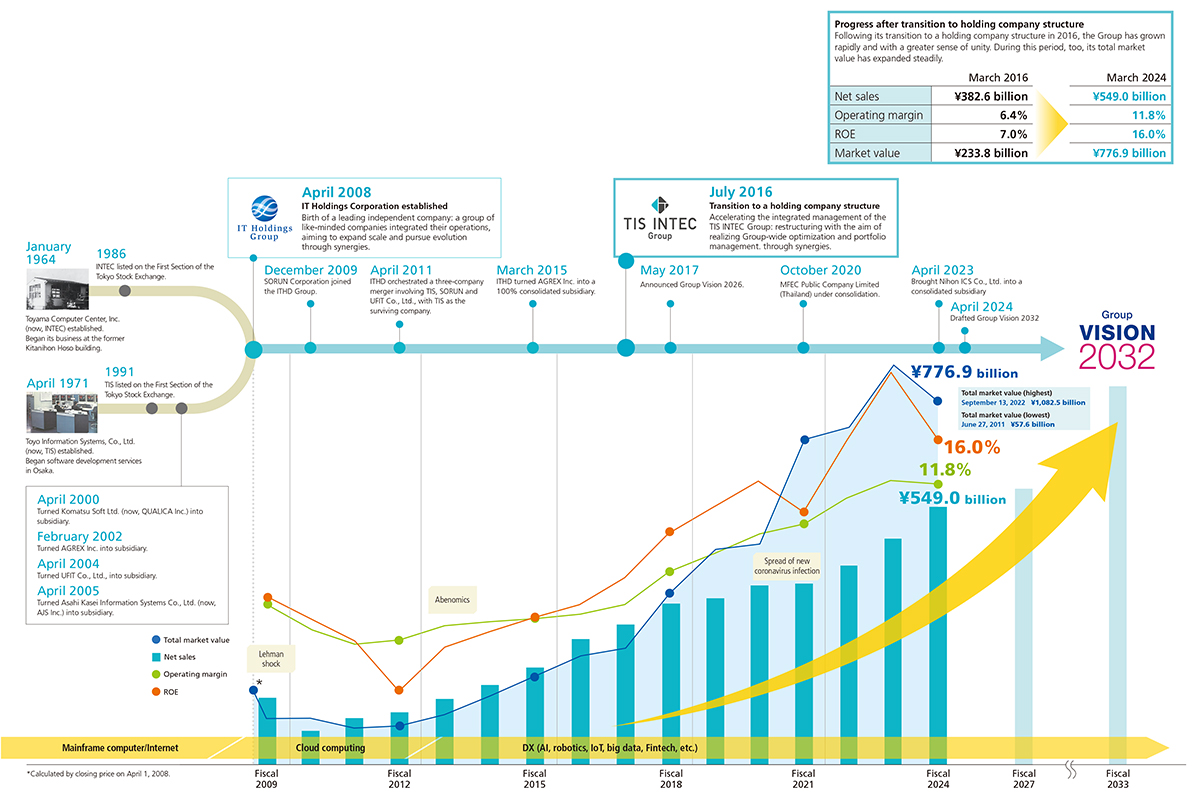

Growth Trajectory

Making the most of the advanced technologies and know-how the TIS INTEC Group has accumulated over the years, we aim to revitalize society and contribute to the well-being not only of our clients, but of society as a whole.

We will continue to challenge ourselves to achieve further growth, contribute to a sustainable society, and realize sustainable enhancement of corporate value based on an unwavering ambition to contribute to the development of society through digital technology.

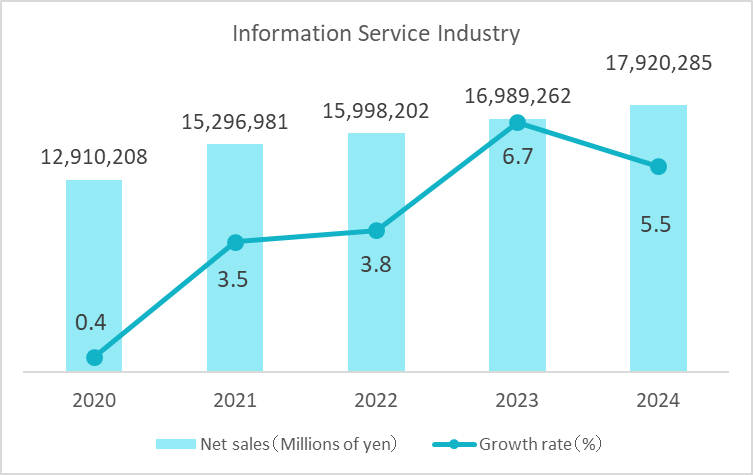

IT Services Market Size

The information services industry, to which the TIS INTEC Group belongs, continues to see a gradual increase in demand. In 2024, the market showed 5.5% year-on-year growth, reaching a value of ¥17.9 trillion and establishing information services as an industry with a promising future to lead innovation and deliver solutions to social issues.

Going forward, with the number of companies embracing digital transformation (DX) on the rise, information service providers who support the DX process are likely to see further growth and wider market scale.

*Source: Materials created by Japan Information Technology Services Industry Association, based on Ministry of Economy, Trade and Industry economic census for business activity and survey of selected service industries

The figures noted above have been adjusted, paralleling revisions by the Ministry of Economy, Trade and Industry.

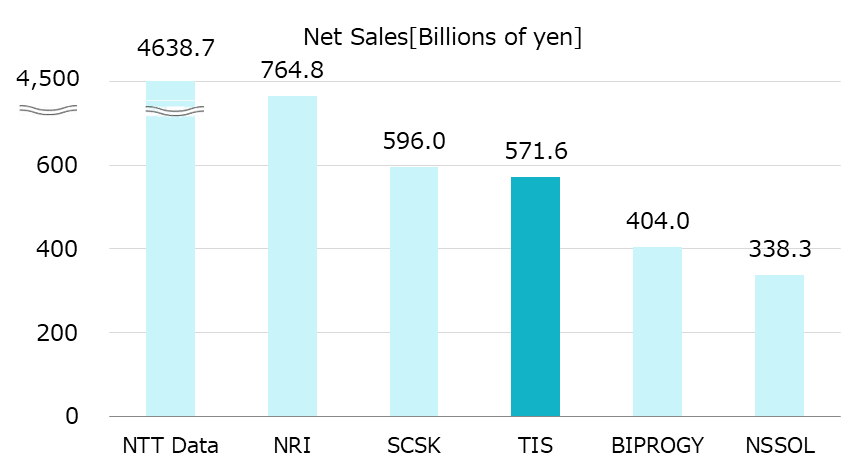

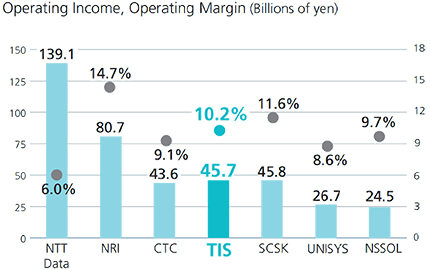

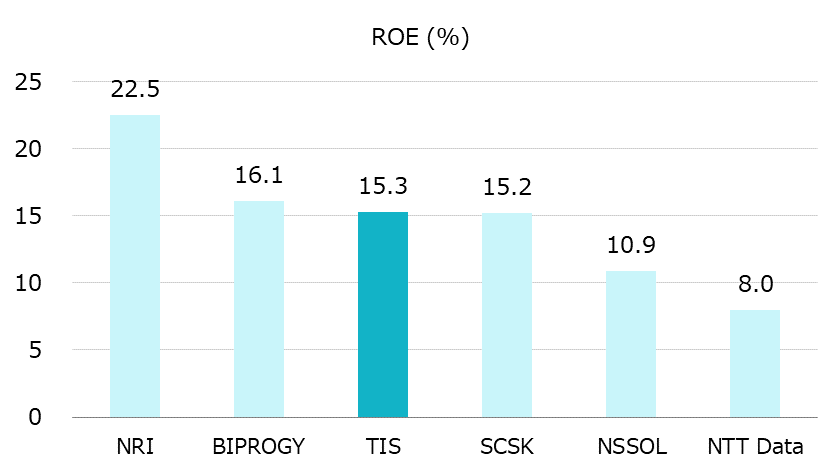

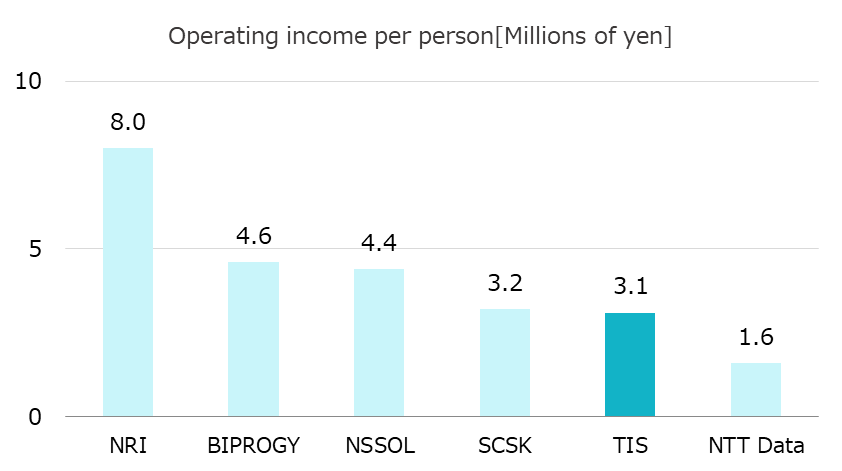

Positioning in the IT Services Market

TIS INTEC Group has cemented a position as a leading, independent prime contractor in Japan’s IT services industry— a market that is expected to continue growing against a backdrop of robust corporate demand for digital technology.

Comparison of Japan’s Leading IT Companies (Year ended March 31, 2025)*1

*1 The full company names used in the above graphs (NTT Data, NRI, SCSK, BIPROGY, and NSSOL) are: NTT Data Group Corporation, Nomura Research Institute, Ltd., SCSK Corporation, BIPROGY Inc., and NS Solutions Corporation. NTT Data, NRI, SCSK, BIPROGY, and NSSOL amounts are based on the IFRS (International Financial Reporting Standards).

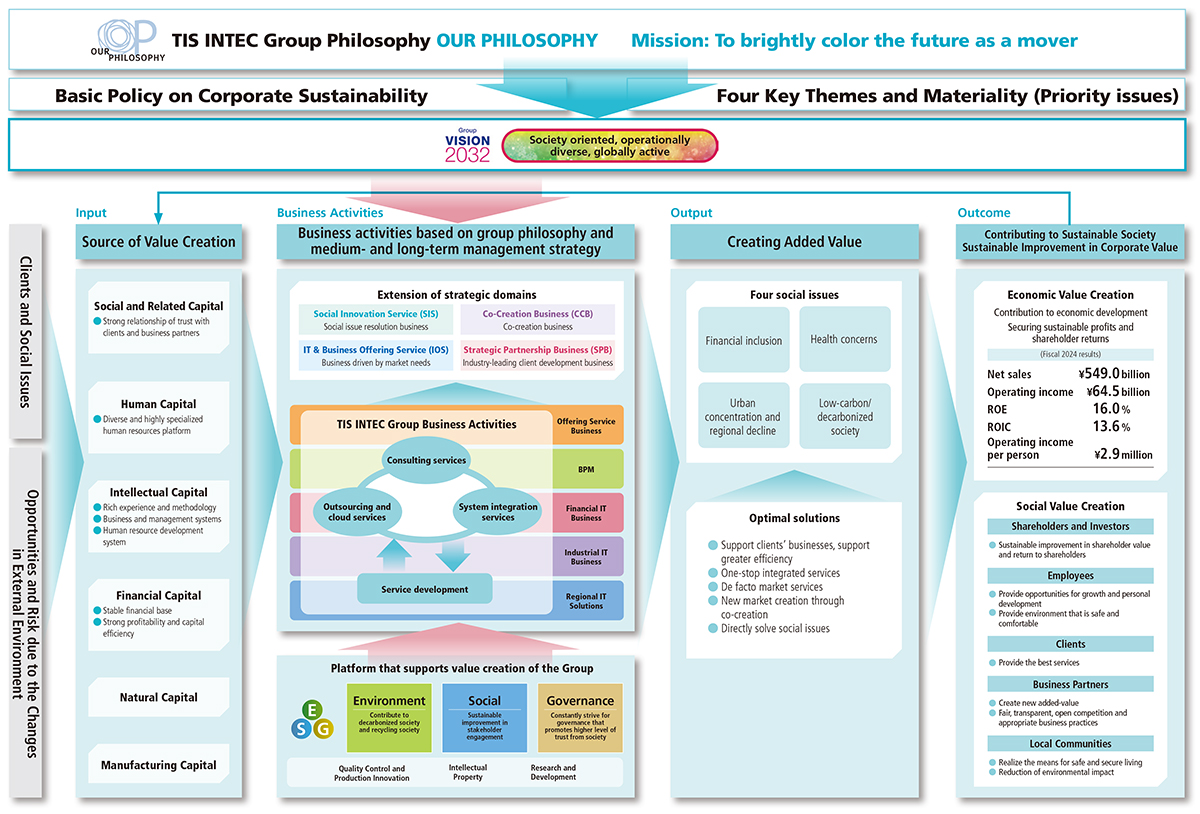

Value Creation Process

We will balance efforts to realize a sustainable society with efforts to achieve sustainable improvement in corporate value by leveraging unified Group management based on OUR PHILOSOPHY, the TIS INTEC Group philosophy.

Business Activities and Composition of Sales by Business Segment

From the fiscal year ending March 31, 2023, TIS applied new management approach and changed business segment.

| Offering Service Business | Configures services through own investment based on best practices accumulated groupwide and provides knowledge-intensive IT services |

|---|---|

| Business Process Management | Applies such strengths as IT expertise, business know-how and skilled human resources to realize and provide higher-level, more-efficient outsourcing solutions targeting business process-related issues. |

| Financial IT Business | Considers business and IT strategies together and leverages both, and supports business progress using expert business and operating know-how specific to the finance industry |

| Industrial IT Business | Considers business and IT strategies together and leverages both, and supports business progress using expert business and operating know-how specific to industry sectors other than finance |

| Regional IT Solutions | Provides IT professional services extensively, across regions and client sites, and collects and develops this know-how as the source of solutions to support efforts to address issues and promote business activities |

*Sales to outside customers, excludes intersegment sales

Composition of Net Sales by Client Sector

Frequently Asked Questions

For questions about our group, please refer to "Frequently Asked Questions"