Message from the Director in Charge of Finance

Financial policy/Basic capital policy

The underlying goal of TIS’ financial policy, and basic capital policies, is to realize sustainable improvement in corporate value through the creation of an optimal capital structure that balances efforts to leverage growth investments, ensure financial health and enrich shareholder returns from a medium- to long-term management perspective. More precisely, we take a robust approach to growth investments and, as part of this process, constantly review our business portfolio so that it generates cash through a steady increase in business profits and improved profitability. Then, through balance sheet management, we maintain financial health and constantly offer returns that exceed the cost of capital by building an optimal capital structure aligned to progress in structural transformation. Meanwhile, we strive to enrich shareholder returns commensurate with business growth.

By implementing measures in line with these capital policies, we have been able to achieve sustainable business growth, enrich shareholder returns and boost capital efficiency. Going forward, we aim to raise corporate value still higher and will steadily implement additional measures in line with these capital policies.

Below, I will outline the rationale and initiatives applied to date and planned for the future in five categories: cash allocation, balance sheet management, growth investment, shareholder returns, and ROE, ROIC and EPS.

Cash allocation

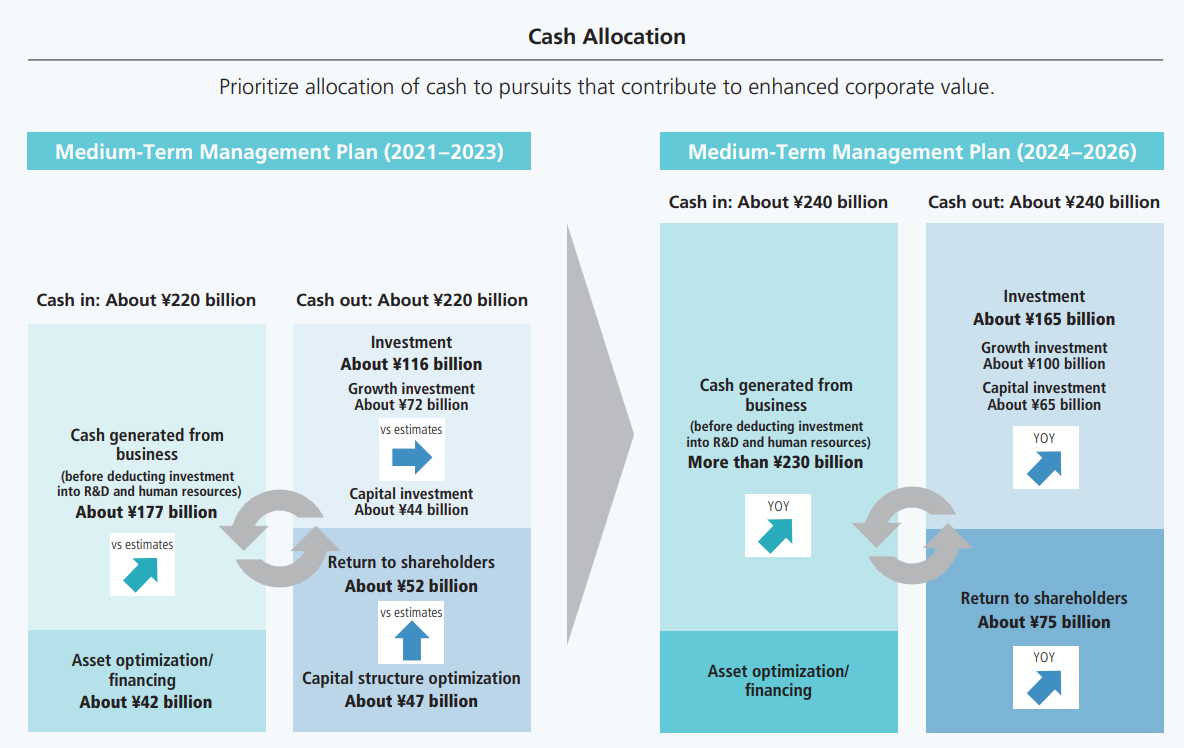

In line with the aforementioned financial policy, and basic capital policies, cash allocation prioritizes measures that contribute to higher corporate value. We aim to create a virtuous cycle that starts with active investment in companies or businesses with the potential to reinforce our ability to generate cash and then use the cash gained from business growth to drive additional growth investments. At the same time, we seek to strike a good balance between such investments and efforts to enhance shareholder returns as we maintain a focus on balance sheet management to boost capital efficiency and build an optimal capital structure.

Cash inflow exceeded expectations under the previous medium-term management plan. This is largely due to an improvement in our ability to generate cash, paralleling business growth and progress in structural transformation driven by returns from growth investments made to date, and also due to such factors as the sale of subsidiaries, following a review of our business portfolio, and a reduction in strategic shareholdings. Taking advantage of greater financial latitude, we complemented efforts to enhance business content, develop the skills and scope of human resources, capitalize on M&A opportunities and strengthen shareholder returns with vigorous but flexible financial measures, such as treasury stock buybacks aimed at building an optimal capital structure.

Details will be provided below, but suffice it to say, prudent allocation of capital resulted in ROE of 16.0% in fiscal 2024, and a three-year EPS CAGR of 22.5%.

Under the new medium-term management plan, we remain keen to expand our capacity to generate cash by growing our businesses and leveraging structural transformation while also optimizing assets and raising funds as investment opportunities dictate. We expect cash-in to reach about ¥240 billion through these efforts. Meanwhile, on the cash-out side, we will allocate about ¥65 billion for capital investments and ¥100 billion for growth investments, and return about ¥75 billion to shareholders through dividends and treasury stock buybacks.

Capital expenditures include a diversified acquisition amount of about ¥42 billion for real estate trust beneficiary rights in a key facility where TIS provides system operation services and a proprietary brand of cloud services. The decision to acquire these rights was made back in March 2023 as an exception to a practice at the time of leasing rather than owning such facilities. While we will stay true to the basic framework, we will always be on the lookout for opportunities to improve corporate value and, as needed, modify approaches and optimize cash allocation to make the most out of changes in the business environment or new growth investment prospects.

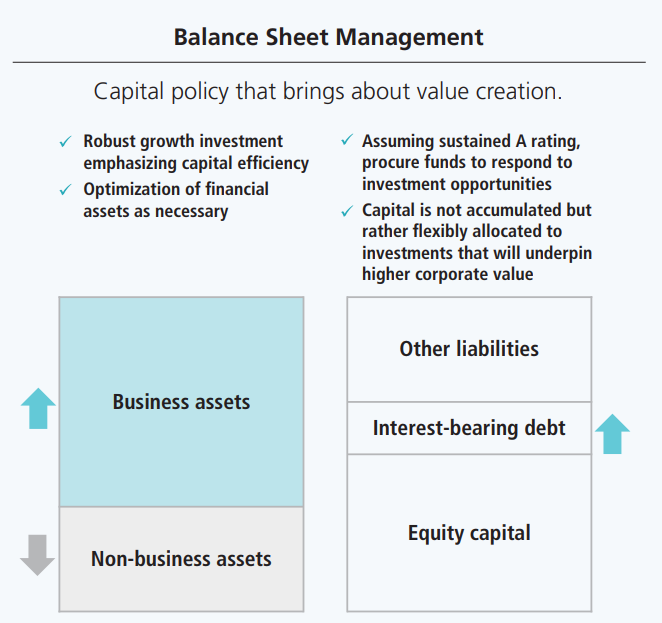

Balance sheet management

The balance sheet, which comprises medium- to long-term capital, or more specifically, management of these financial assets, is the cornerstone of sustainable improvement in our ability to generate cash and continuously deliver returns that exceed cost of capital. Essentially, balance sheet management is a capital policy that brings about value creation. But this cannot be achieved through short-term profit and loss management alone.

Under the previous medium-term management plan, business assets increased significantly. This reflects higher software assets—software account grew about ¥5 billion over three years, to more than ¥20 billion—due to robust investment to leverage structural transformation, and higher associated assets driven by M&A activity, notably, Nihon ICS. Meanwhile, non-business assets recorded on the balance sheet as of March 31, 2024, came to ¥26.7 billion, down about ¥19.3 billion from three years earlier, owing to a particularly persistent effort to reduce strategic shareholdings. As a result, we were able to push the strategic shareholding ratio—strategic shareholdings as a percentage of consolidated net assets—down to the targeted 10% level already by the end of fiscal 2023, a year ahead of schedule. The quality of capital management methods has improved and, given growing confidence that this trend will continue and with an eye to financial health, we carried out large-scale treasury stock buybacks totaling about ¥47 billion in fiscal 2023 and fiscal 2024 in our pursuit of an optimal capital structure. All repurchased treasury stock was cancelled, in line with our policy to limit holdings of treasury stock to 5% of the total number of shares outstanding and cancel the excess. As a result, the equity ratio for fiscal 2024 slipped 4.7 points year on year, to 59.5%.

Under the new medium-term management plan, we will continue to emphasize capital efficiency and will reinforce business assets through robust growth investment activity as well as the accumulation of intellectual property to support structural transformation and an expanded scale of business. We will keep cash and deposits to a set level, complemented by commitment lines, totaling the equivalent of about two months’ worth of sales, and we will avoid accumulating excessive amounts of non-business assets, primarily financial assets, and, conscious of capital costs, strive to reduce such non-business assets. In addition, assuming TIS can maintain an “A” rating and ensure financial health, management will allow a debt–equity ratio of up to 0.5, eyeing possible use of interest-bearing debt to cover M&A and the increase in facilityrelated assets mentioned above. We will take a flexible approach to allocating capital for investment with the potential to increase corporate value, rather than accumulating it, since we expect capital to accumulate in line with sustainable profit growth.

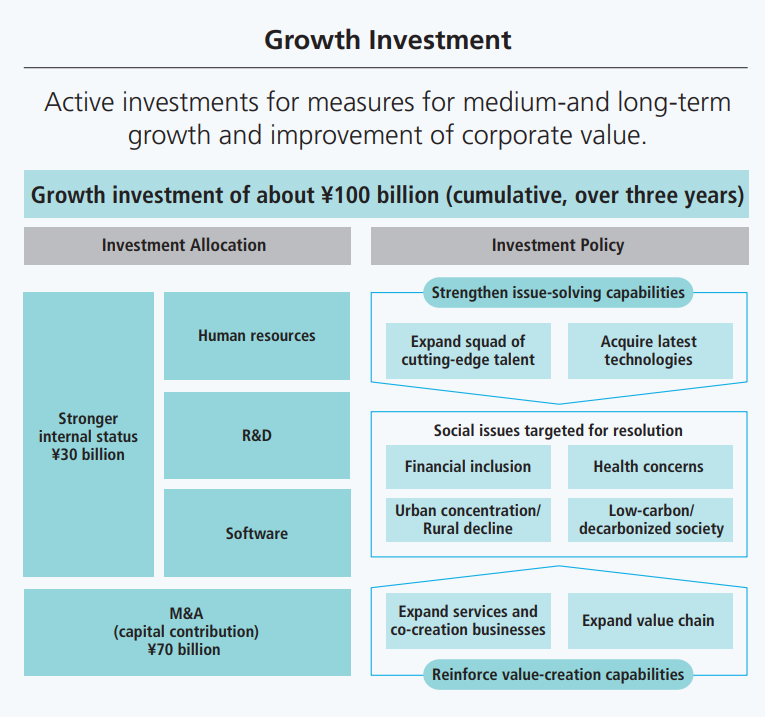

Growth investments

Under the previous medium-term management plan, we budgeted for growth investments of about ¥100 billion, and investments in human resources, primarily R&D and education and training, as well as investments to promote service-based business, were generally in line with the budgeted amount. In regard to M&As and capital contributions, notably, Nihon ICS, external factors significantly influenced our investment decision process and, after carefully assessing opportunity and timing, we set a limit of about ¥34 billion for growth investments. But the amount was not set in stone and, after reviewing our investment allocation, we took the initial step of significantly improving employee benefits to a value of about ¥5 billion as an upfront investment in human resources, our most important management capital. This allocation of funds reflects nationwide discussions surrounding base salary increases and the expectations of our stakeholders, and we were the first in our industry to act. We didn’t stop there, proactively implementing investments that will contribute broadly to enhanced corporate value. This includes allocation of about ¥47 billion for financial measures to support an optimal capital structure.

Under the new medium-term management plan, about ¥100 billion has been earmarked for growth investments over three years, reflecting our firm belief that robust investment activity is critical to improvement in corporate value. Our aim in investing in human resources as a means of strengthening in-house capabilities is to put into motion a virtuous cycle of value exchange between employees and the company. Essentially, as indicated on human resources strategies, a virtuous cycle will motivate employees to embrace challenges while also helping TIS and the TIS INTEC Group realize the underlying strategy of frontier development described in the new medium-term management plan. We set operating income per person as a new metric to measure return on investment, and we are determined to show growth through investment.

In other approaches to strengthen in-house capabilities, we will budget a total of ¥30 billion for R&D to accelerate the creation of cutting-edge technologies and new businesses and for software to expand our service lineup, address social issues and build industry platforms. We will also allocate ¥70 billion for M&A, including capital contributions. I venture to say that the main objective of M&A and other activities to establish a wider presence, whether at home or abroad, is to leverage offering services and co-creation businesses and to expand the value chain. To support this objective, we will set hurdle rates based on weighted-average cost of capital, or WACC, and carefully consider and execute our wider-presence strategy while adhering to disciplined investment that will help raise our ROIC level over the long term.

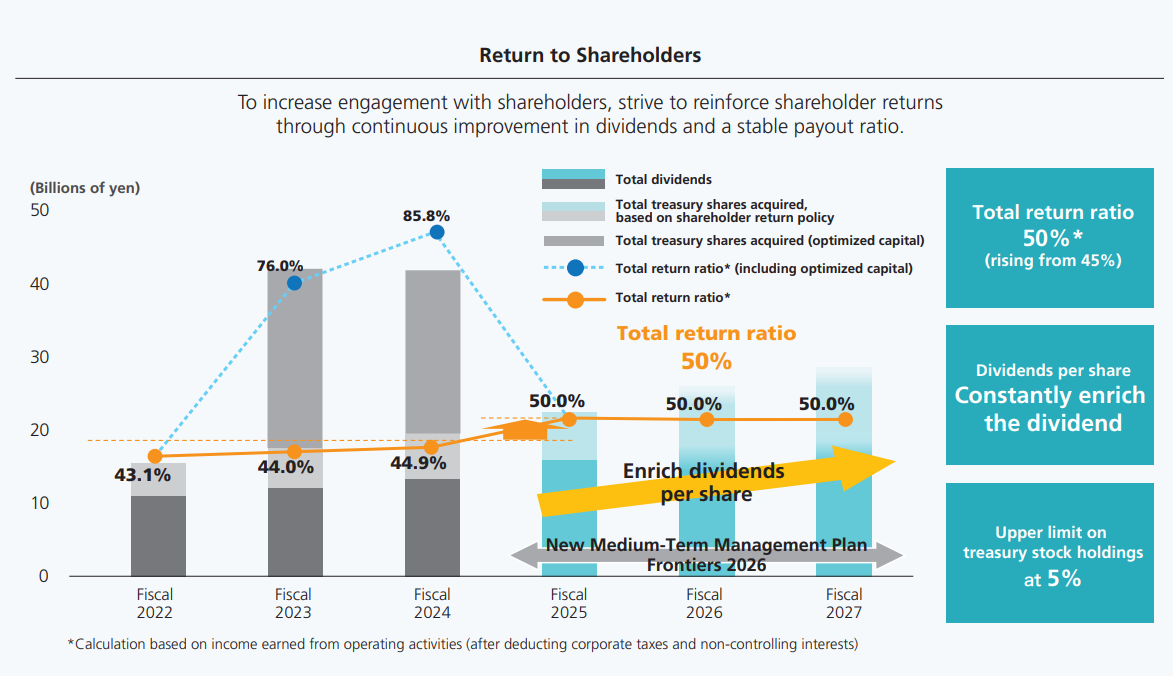

Shareholder returns

The return of profits to shareholders is an important management priority, and to ensure continuous improvement in shareholder returns commensurate with business growth, the Company calculates dividends based on income from operating activities not affected by temporary profits or losses. Under the previous medium-term management plan, we provided shareholder returns based on a total return ratio yardstick of 45%. The dividend for fiscal 2024 was up, marking the 12th consecutive year of increase, and by an amount higher than initially forecast, paralleling business growth exceeding expectations in each year of the three-year plan. We feel attractive shareholder returns are an integral part of engagement with shareholders. Our basic approach remains unchanged under the new medium-term management plan, but we aim to reinforce our connection to shareholders by maintaining the upward trend in dividends per share and ensuring payment stability, including the equalization of interim and year-end payouts. We will also raise the total return ratio yardstick, including acquisition of treasury stock, to 50% from the current 45%, thereby reinforcing shareholder returns. As a general rule, we will continue to repurchase and hold treasury stock, up to a maximum of 5% of the total number of shares outstanding, and cancel any excess.

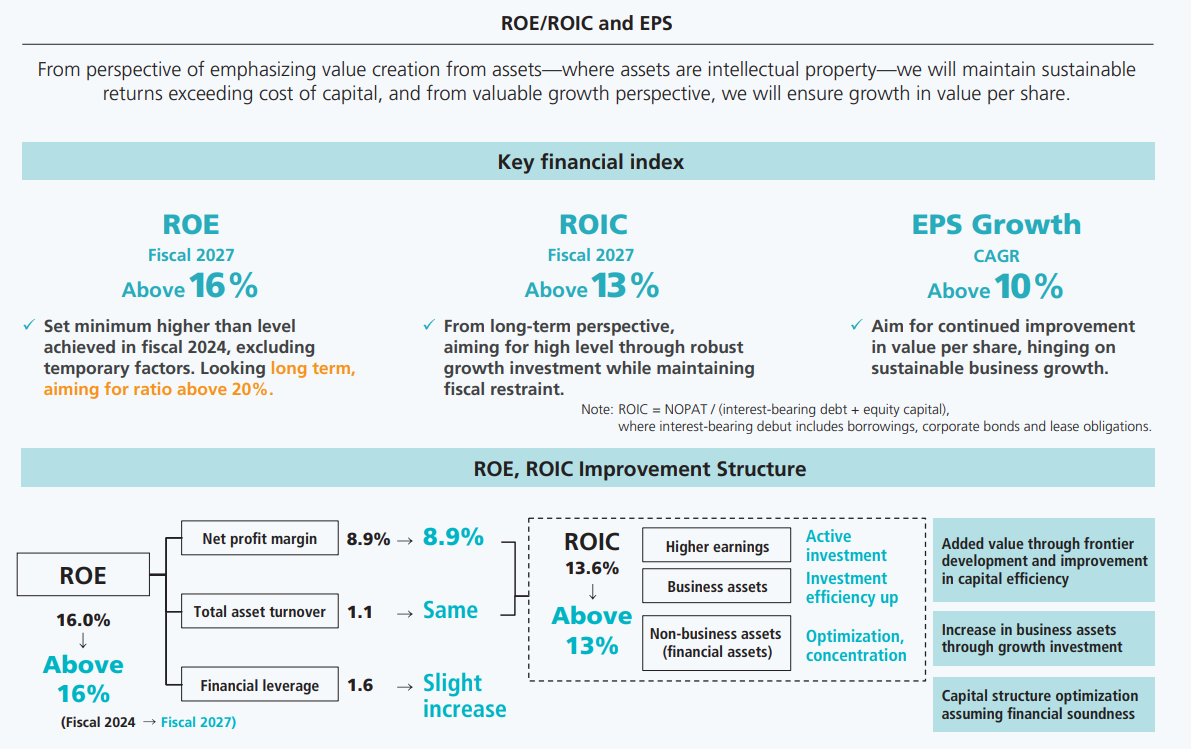

ROE/ROIC, EPS

ROE/ROIC

Under the previous medium-term management plan, we successfully raised ROE to 16%, significantly exceeding even the upper end of the targeted 12.5–13% range, through not only agile implementation of financial measures tailored to prevailing conditions but also a favorable shift in business activities, which generated higher profits. This achievement also reflects the positive impact of extraordinary income and other factors on our net income ratio. But even if we discount such one-off factors, ROE would probably still have settled in the 14% range, above the upper end of our estimate. As a result, I believe we have come closer to our long-term goal of becoming a company that can consistently achieve ROE of 15%.

Under the new medium-term management plan, we will continue to promote management conscious of capital efficiency and, from the perspective of exceeding recent performance, excluding one-off factors, we have set a minimum target for ROE above the 16% achieved in fiscal 2024, with a long-term goal of more than 20%. In addition, from a perspective emphasizing value creation from assets— which here, equates to intellectual property—we decided to introduce ROIC as a new management metric. Over the three years of the new medium-term management plan, we aim to realize ROIC above 13%, assuming a slight decrease due to robust growth investment activity. We feel that efforts to create benefits from growth investment will, with a disciplined financial approach over the long term, lead to a high ROIC.

EPS

Under the previous medium-term management plan, we achieved EPS CAGR of 22.5%, greatly exceeding our target of 10%. The fuel for this tremendous result was business growth along with proactive steps, namely, selling off certain subsidiaries and a reduction in strategic shareholdings following a review of our business portfolio, and a robust, flexible approach to implementation of financial measures to optimize capital structure. Notwithstanding this EPS CAGR result, we will stick to the same 10% target under the new medium-term management plan as well, based on a “valuable growth” perspective, with a focus on both financial and business strategies driving achievement.

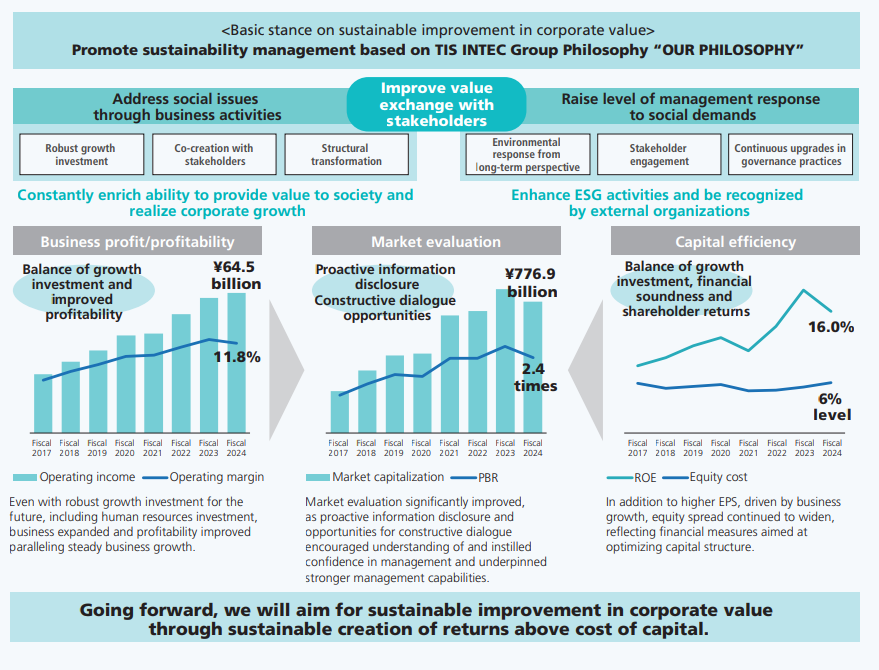

Seeking to improve corporate value

We seek to contribute to a sustainable society while continuously increasing corporate value through TIS INTEC Group philosophy “OUR PHILOSOPHY,” which forms the backbone of efforts to promote sustainability management throughout the Group and improve value exchange with stakeholders. In addition, conscious of capital costs, we have pursued proactive information disclosure, including efforts in human capital management, and constructive dialogue opportunities to encourage understanding of and confidence in management capabilities. Also, investing in growth for the future includes investing in human resources, and we have been successful thanks to a robust approach to growth investment that has buoyed business profits and profitability. At the same time, we have prioritized financial measures to optimize capital structure, with our equity spread continuing to widen. I believe management results like this underscore our ability to meet the expectations of shareholders, typified by a significant improvement in market valuation.

Building on the successes we have achieved to date, we will strive to improve corporate value and become a company brimming with hope for the future. This will help ensure that we remain the top choice for the market and shareholders. We will continue to boost corporate value through robust capital policies under a disciplined management approach. We will maintain a capital cost perspective, acknowledging the importance of sustainable returns that exceed cost of capital while balancing active investment for growth with improved profitability and constantly enriching shareholder returns commensurate with growth in business profits. Furthermore, we see engagement with shareholders and investors as opportunities to gather a variety of comments and opinions that may prove to be extremely valuable in designing future policies. I know we have applied insights gained from such engagement opportunities in making necessary adjustments to existing management methods. In other words, I think it would be fair to say that shareholders and investors have complemented our own efforts to strengthen management and enhance corporate value, and we will continue to actively connect, using dialogue as our point of contact, to understand and meet shareholder expectations.

September 30, 2024

Masakazu Kawamura

Managing Executive Officer, Division Manager of Corporate Planning SBU