Medium-term Strategies

Medium-Term Management Plan (2024-2026)

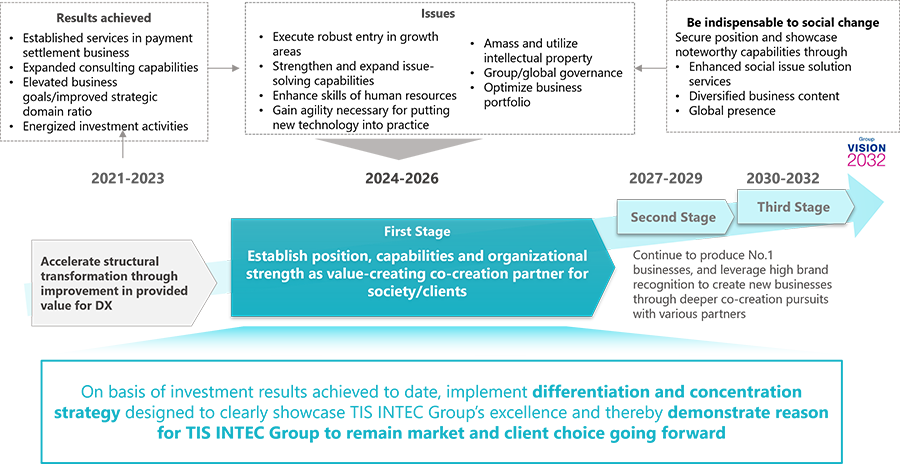

Position of Medium-Term Management Plan (2024-2026)

Under Medium-Term Management Plan (2024-2026), a three-year plan guiding the Group from April 2024, we will tie relationships forged with clients and each type of investment made during previous medium-term management plan to results. At the same time, we will use this time as the first stage of our journey to realize Group Vision 2032, building on the results of investments executed to date to further differentiate and concentrate activities designed to establish clear superiority and thereby demonstrate why the TIS INTEC Group should remain a market and client choice going forward.

For details about Group Vision 2032, go to Group Vision .

Slogan

Setting frontier development as a fundamental strategy, we will strive to enhance quality across all value chains, with an emphasis on forward-looking market development and business domain expansion, and successfully acquire market position and capabilities that lead to the next stage of growth and renewed corporate strength.

Basic Policies

We will set frontier development as a fundamental strategy and strive for sustainable growth paralleling higher added value. We will strive to achieve changes in society and for corporate clients by enhancing quality across all value chains, starting with forward-looking market development and business domain expansion.

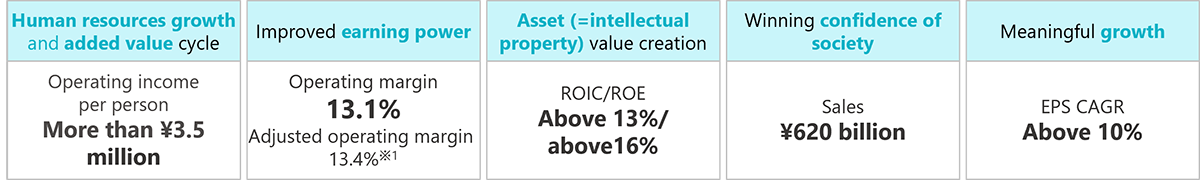

Key Performance Indicators

*1 Adjusted operating income margin: Calculated by adding goodwill amortization cost back to operating income.

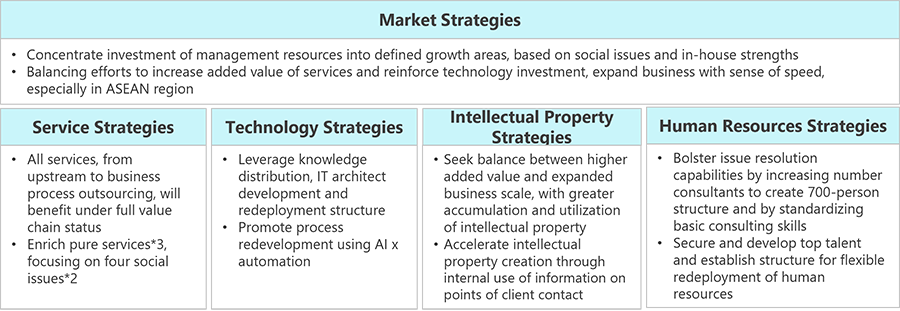

Priority strategies

*2 Financial inclusion, urban concentration/rural decline, low-carbon/decarbonization, and health concerns. These issues were determined by backcasting from what the world might be like in 2050 and selected on the basis of TIS INTEC Group's ability to contribute to issue resolution.

*3 Type of services essentially offered under uniform specifications applicable to all clients.

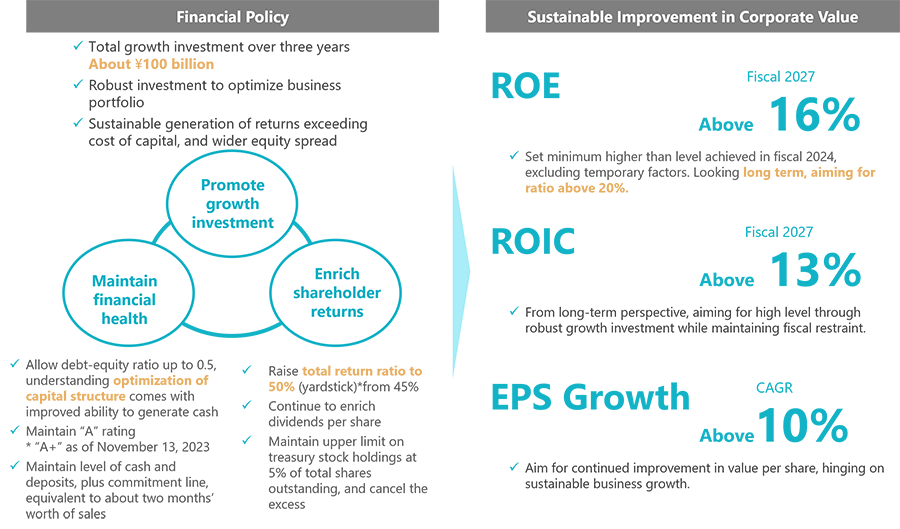

Financial Policy

Realize sustainable growth through robust growth investment on firm financial footing, and boost corporate value still higher through a balanced approach emphasizing improved capital efficiency and enhanced shareholder returns.

Note: ROIC = NOPAT / (interest-bearing debt + equity capital), where interest-bearing debut includes borrowings, corporate bonds and lease obligations.

Performance Targets

| Consolidated | Fiscal 2027 ending March 31, 2027 (estimate) |

(For reference) Fiscal 2024, ended March 31, 2024 (actual) |

|---|---|---|

| Net Sales | ¥620.0 billion | ¥549.0 billion |

| Gross profit margin | 30.0% | 27.6% |

| Operating Income | ¥81.0 billion | ¥64.5 billion |

| Operating Margin | 13.1% | 11.8% |

| Net Income Attributable to Owners of the Parent Company | ¥55.0 billion | ¥48.8 billion |

| EPS Growth CAGR | Above 10% | 22.5% |

| ROE | Above 16% | 16.0% |

Basic Policy on Return to Shareholders

The Company regards the return of profits to shareholders as a key management decision and has adopted a basic policy of maintaining sufficient internal reserves required for business growth from a medium- to long-term management perspective, while continually paying a stable dividend in consideration of its consolidated financial results.

Through the medium-term management plan(2024-2026) , Balancing efforts to leverage growth investment, maintain financial health and strengthen return to shareholders, TIS will lay the groundwork for an increase in the total return ratio yardstick to 50%, from 45%, and constantly enrich dividends per share.

In so doing, the Company will raise shareholder engagement.

*Total return ratio: Ratio of dividends and treasury stock buybacks to income attributable to owners of the parent

For details on return to shareholders, go to Shareholder Return .

Briefing Materials for Medium-Term Management Plan (2024-2026)