Message from the Director in Charge of Finance

Financial Policy: Basic capital policies

Realize sustainable improvement in corporate value through the creation of an optimal capital structure that balances efforts to leverage growth investments, ensure financial health and enrich shareholder returns from a medium- to long-term management perspective

- Take robust approach to growth investments and, as part of this process, constantly review and restructure business portfolio to reinforce ability to generate cash through sustainable increase in business profits and improved profitability.

- Through stronger balance sheet management, build optimal capital structure aligned to progress in structural transformation to maintain financial health and constantly deliver returns that exceed cost of capital.

- Strive to enrich shareholder returns commensurate with business growth.

Q. Remind us of the key financial policy indicators in Medium-Term Management Plan (2024–2026).

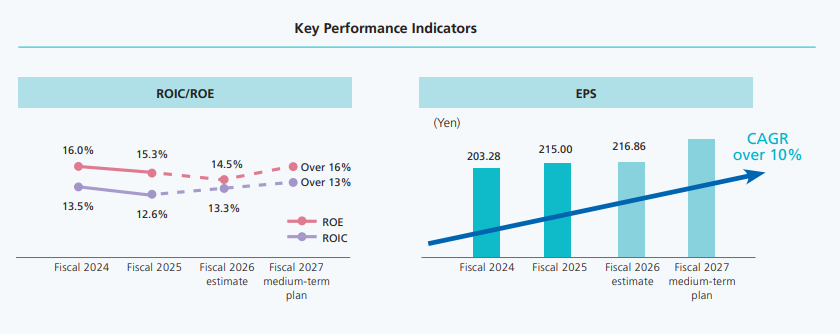

TIS has long promoted management conscious of capital efficiency. With this in mind, we are working toward ROE above 16% by fiscal 2027, higher than the level recorded in fiscal 2024, excluding one-time factors. But in the long term, we are aiming for ROE above 20%, which is considered high for the IT industry.

ROIC (return on invested capital), like ROE, reflects an emphasis on value creation from assets, which equates to intellectual property, and was introduced as a new management metric. Over the three years of the current medium-term management plan, we are aiming for ROIC above 13%, assuming a slight decrease due to robust growth investment activity. We feel that efforts to derive benefits from growth investment will lead to higher ROIC over the long term.

For EPS (earnings per share), we will stick to the same 10% Compound Annual Growth Rate target set under the previous medium-term management plan, based on a “valuable growth” perspective, and work toward 10% by leveraging financial strategies aligned with business strategies.

Q. How would you evaluate fiscal 2025, the first year of Medium-Term Management Plan (2024–2026)?

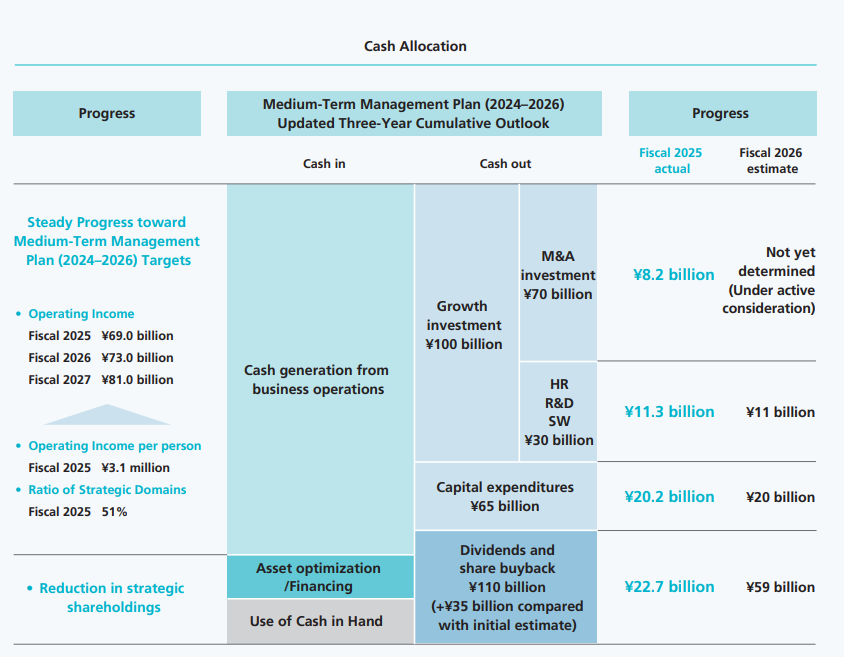

On a performance basis, we struggled somewhat as activity on two large finance-related development projects—key drivers of growth up to and including fiscal 2024, the last year of the previous medium-term management plan—fell from peak service status at the same time, with significant impact on performance. But we were able to maintain business growth overall by promoting high-value-added services and capitalizing on strong IT investment demand in a favorable business environment. We exceeded our initial estimate and moved into the second year of the current medium-term management plan on a solid footing. That said, we have to accelerate profit growth if we are to achieve our operating income target of ¥81 billion by fiscal 2027, the last year of Medium-Term Management Plan (2024–2026). We will continue to engage in robust business development and leverage growth investments to support this process.

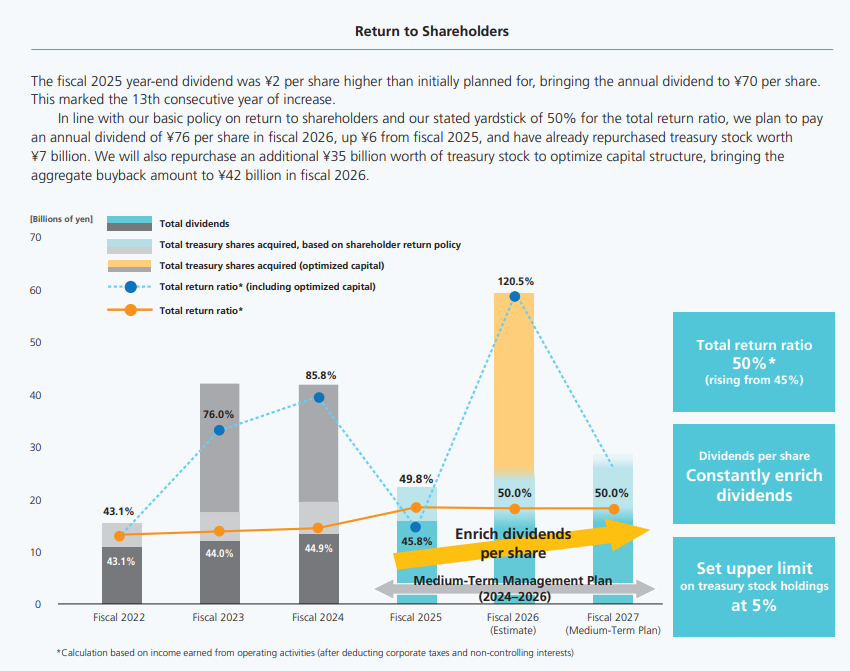

In regard to counterpart financial measures, we began fiscal 2025 knowing full well that growth investments are essential to the significant profit growth we seek, and that such investments should be prioritized in the allocation of capital. With regard to shareholder returns, we have raised dividends for 13 consecutive years and implemented treasury stock buybacks worth about ¥6.4 billion to underpin progress toward a 50% total return ratio, up from the previous benchmark of 45%. On the strategic shareholdings front, we successfully pushed the ratio of total strategic shareholdings to net assets below 10%, but continued to seek reduction, squeezing the ratio to 6.5%, down 1.7 points year on year. Growth investments settled at ¥19.5 billion. We maintained steady investment—to the tune of ¥11.3 billion—to strengthen in-house capabilities and, although we actively considered M&A opportunities and other business-building pursuits, we only applied ¥8.2 billion to expand our presence, reflecting a disciplined approach to investment that puts large investments on a back burner. Over the three years of Medium-Term Management Plan (2024–2026), there will be no change in our stance on robust growth investment, supported by a framework of ¥100 billion—¥30 billion to reinforce in-house capabilities and ¥70 billion for M&A and other activities to establish a wider presence—but the end of the first year of the plan highlighted issues with a growing cash position and increased equity capital that we must address.

Q. You say the ¥100 billion framework for growth investment will not change, but might you revisit the approach to cash allocation?

Our basic approach to cash allocation is to distribute funds in a timely and appropriate manner to business pursuits that will drive corporate value higher. An underlying priority in decisions on allocation is to strike a balance among promoting growth investments aimed at sustainably increasing corporate value, ensuring financial soundness, and enhancing shareholder returns, as stipulated in basic financial and capital policies.

The information services industry, to which the TIS INTEC Group belongs, has seen remarkable growth, with a noted increase in recent years toward business expansion, including large-scale M&As. Against this backdrop, we will continue on a groupwide basis to actively explore investment aimed at M&As and capital contributions that lead to discontinuous growth. As I mentioned earlier, we earmarked ¥70 billion over three years, and used only ¥8.2 billion of the allocated amount in the first year. But in the execution of investments, timing and scale vary depending on the target or type of investment, and the conservative use of capital for investments in the first year should not be construed as slow progress toward application of earmarked funds.

We have to be flexible, not only in executing growth investments but also in implementing capital policies to maximize opportunities. Therefore, we will take an open approach, focusing on optimal distribution of capital for initiatives that contribute to enhanced corporate value, tempered by the state of our balance sheet and cash position at the time of cash allocation. Actual results will validate the rationality of this approach.

Q. TIS views acquisition of treasury stock as a strategic tool to optimize its capital structure. What led to the recent buyback decision?

Our intention was to improve capital efficiency, and our financial strategy states that measures to optimize capital structure will be implemented flexibly, taking into account prevailing circumstances. We set a target of at least 16% for ROE as an indicator of capital efficiency, but the market raised concerns that the target was unattainable based on profit estimates and proposed allocation of cash as described in Medium-Term Management Plan (2024–2026). We had to respond.

In addition, when we looked at the state of our balance sheet at fiscal 2025 year-end, on March 31, 2025, we realized that we would have to optimize capital structure, given that our equity ratio had expanded to 61.5% and our cash position was also trending upward due to a stronger earnings base paralleling business growth. These factors were behind the Board’s decision to acquire an additional ¥35 billion equivalent in treasury stock on top of the ¥7 billion equivalent buyback executed in line with our basic policy on shareholder returns, for an aggregate acquisition amount of ¥42 billion.Consequently, we were able to demonstrate a clear path toward achieving ROE above 16% and also set the stage for similar progress toward our EPS target.

This awareness of capital efficiency and a commitment to take the steps necessary to reach stated targets were favorably received by shareholders and investors, indicating that management met their expectations. A commendable result, indeed.

Q. What prompted TIS to enhance disclosure of measures aimed at achieving management conscious of capital cost and stock price?

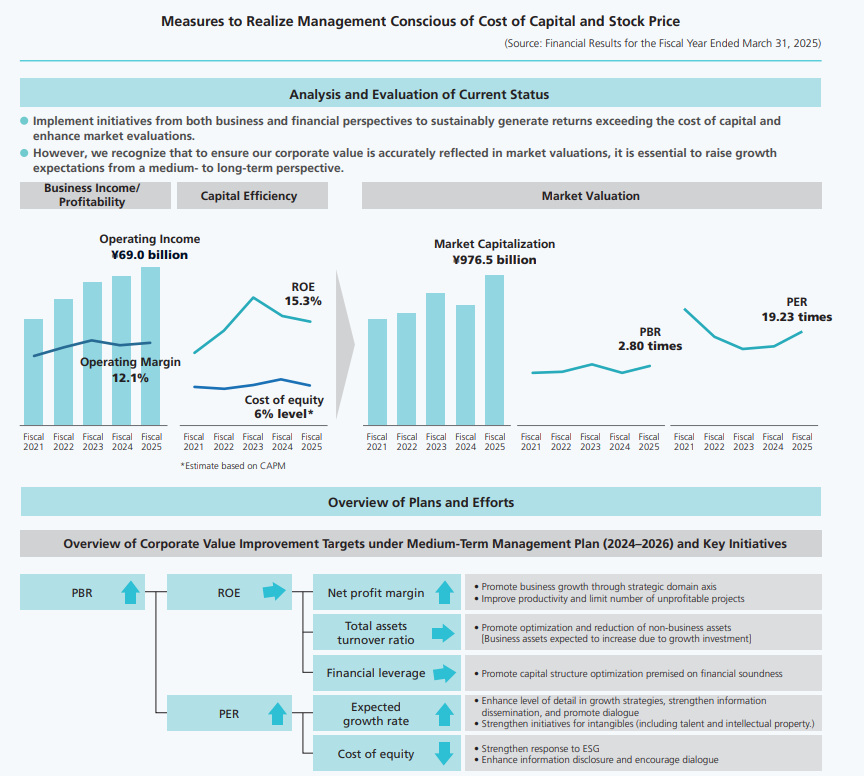

As presented in Analysis and Evaluation of Current Status, we sustainably generated returns above the cost of capital and, accordingly, raised market assessment by achieving steady business growth and maintaining successful capital policies. However, in recent years, the number of large-scale projects that had been driving business results fell from its peak, and we haven’t been able to present a clear growth strategy or progress in service-oriented activities that would enable us to neutralize the impact and achieve strong growth. The market is increasingly of the view that we have reached a growth plateau, so to speak, and PER obviously isn’t charting a stable upward trajectory. Sluggish improvement in PER means we lack a powerful contributing factor to higher PBR, which is an important indicator of corporate value.

Of course, we discussed the situation internally to understand and remedy underlying causes. But we felt it was vitally important to delve deeper into perceived issues, clearly articulate our perspective on and approach to further growth, and foster higher expectations for growth through enhanced engagement with shareholders and investors. This required an expanded level of disclosure. Of note, as shown in the PBR logic tree in Overview of Plans and Efforts, we identified issues and initiatives to facilitate responses with a sense of urgency and speed, as well as to more easily share content with shareholders and investors. We also hope to convey the idea that corporate growth and value improvement depend on the intrinsic value of TIS being reflected in market valuation.

Q. What issues were identified from the PBR logic tree, and what solutions have been implemented?

As I mentioned before, our PER isn’t rising, and our expected growth rate is particularly low and that, unfortunately, erodes our position in the market, specifically in terms of comparison with our competitors in the IT industry. This is most obvious in the prevailing market perception that the performance targets we set for fiscal 2027, the last year of the current mediumterm management plan, are unrealistic. Our first course of action must therefore be to increase the likelihood that we can achieve stated targets, which is, of course, incumbent upon solid business results.

We also recognized the need to prioritize efforts to very clearly present our narrative of strong growth driven by a favorable business environment, highlighting progress in service-based businesses, which we have emphasized for some time, and initiatives and investments in human capital, our most valuable corporate asset, which fuels business success. Underpinned by our growth narrative and a track record of results, we will give shareholders and the investor community a better understanding of TIS and the TIS INTEC Group and raise expectations of success. We believe that intrinsic value will push PBR higher, and this is an important theme for us right now.

Q. Do you have a message for shareholders and investors?

To reiterate, through management practices guided by OUR PHILOSOPHY—the Group’s basic philosophy—TIS and the rest of the TIS INTEC Group strive to create social and economic value, contribute to a sustainable society, and achieve lasting improvement in corporate value. TIS will continue to promote measures from both financial and business perspectives and endeavor to become a company brimming with promise for the future and a premier choice for the market and for shareholders. To this end, in allocating capital, we will emphasize proactive investments for growth, including investment in our most precious asset—our people—which will create a virtuous cycle that reinforces cash generating capabilities. At the same time, we remain committed to enriching shareholder returns.

Engagement opportunities with shareholders and investors tend to produce all sorts of comments and opinions, some of which are critical of management decisions or corporate direction. However, every comment—whether positive or negative—is extremely valuable because it has been extended as advice and insight from a stakeholder’s perspective. Each is a form of support from a long-term perspective with the underlying expectation that TIS will grow in a business sense and improve corporate value.

In fact, management has drawn on input from shareholders and investors when considering and implementing steps necessary to achieve growth. In other words, I think it’s fair to say that you, our shareholders and investors, have been integral in enabling us to enhance management practices, maintain management discipline and increase corporate value. Nothing will change this sentiment. We will continue to actively engage in dialogue with you and all stakeholders to further reinforce management practices and corporate value, and strive to meet your expectations.

September 30, 2025

Masakazu Kawamura

Managing Executive Officer, Division Manager of Corporate Planning SBU