Shareholder Return

Basic Policy on Return to Shareholders

The Company regards the return of profits to shareholders as a key management decision and has adopted a basic policy of maintaining sufficient internal reserves required for business growth from a medium- to long-term management perspective, while continually paying a stable dividend in consideration of its consolidated financial results.

Through the medium-term management plan(2024-2026) , Balancing efforts to leverage growth investment, maintain financial health and strengthen return to shareholders,TIS will lay the groundwork for an increase in the total return ratio yardstick to 50%, from 45%, and constantly enrich dividends per share.

In so doing, the Company will raise shareholder engagement.

Promote growth investment

- Total growth investment of about ¥100 billion over three years

- Robust investment to optimize business portfolio

- Will pursue sustainable creation of returns exceeding cost of capital and broaden equity spread

Strengthen return to shareholders

- Raise total return ratio to 50% (yardstick) *from 45%

- Continue to enrich dividends per share

- Maintain upper limit on treasury stock holdings at 5% of total shares outstanding, and cancel the excess

Maintain financial health

- Allow debt-equity ratio up to 0.5, understanding optimization of capital structure comes with improved ability to generate cash

- Maintain "A rating"

- Maintain level of cash and deposits, plus commitment line, equivalent to two months' worth of sales

For details on medium-term management plan, go to Medium-term Strategies .

Dividends

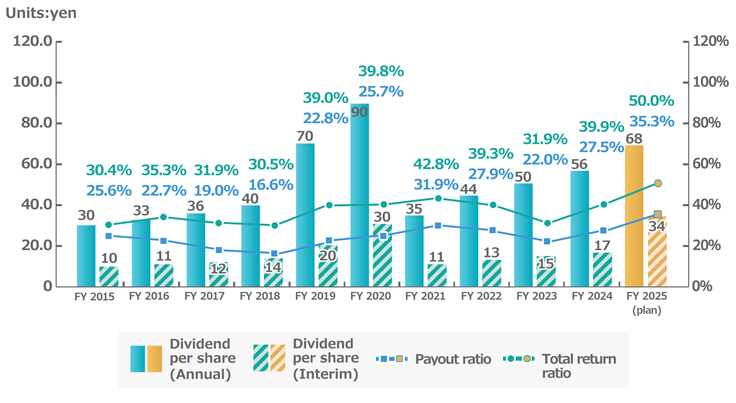

* The Company carried out a three-for-one common stock split on April 1, 2020.

The impact of said stock split is reflected in "Dividends per share" from fiscal 2021.

* In fiscal 2023, TIS executed a treasury stock buyback in line with basic policy stating a total return ratio of 45% (yardstick) in addition to a treasury stock buyback implemented under efforts to optimize capital structure. The total return ratio excludes the buyback of treasury stock implemented to optimize capital structure.

* In fiscal 2024, TIS executed a treasury stock buyback in line with basic policy stating a total return ratio of 45% (yardstick) in addition to a treasury stock buyback implemented under efforts to optimize capital structure. The total return ratio excludes the buyback of treasury stock implemented to optimize capital structure.

* In fiscal 2026, TIS executed a treasury stock buyback in line with basic policy stating a total return ratio of 50% (yardstick) in addition to a treasury stock buyback implemented under efforts to optimize capital structure. The total return ratio excludes the buyback of treasury stock implemented to optimize capital structure.

|

|

Dividend per share | Payout ratio | Total return ratio |

||

|---|---|---|---|---|---|

| (Interim) | (Year-end) | (Annual) | |||

| Fiscal 2026(plan) | 38 yen | 38 yen | 76 yen | 35.0% | 50.0% |

| Fiscal 2025 | 34 yen | 36 yen | 70 yen | 32.6% | 45.8% |

| Fiscal 2024 | 17 yen | 39 yen | 56 yen | 27.5% | 39.9% |

| Fiscal 2023 | 15 yen | 35 yen | 50 yen | 22.0% | 31.9% |

| Fiscal 2022 | 13 yen | 31 yen | 44 yen | 27.9% | 39.3% |

| Fiscal 2021 | 11 yen | 24 yen | 35 yen | 31.9% | 42.8% |

| Fiscal 2020 | 30 yen | 60 yen | 90 yen | 25.7% | 39.8% |

| Fiscal 2019 | 20 yen | 50 yen | 70 yen | 22.8% | 39.0% |

| Fiscal 2018 | 14 yen | 26 yen | 40 yen | 16.6% | 30.5% |

| Fiscal 2017 | 12 yen | 24 yen | 36 yen | 19.0% | 31.9% |

| Fiscal 2016 | 11 yen | 22 yen | 33 yen | 22.7% | 35.3% |

| Fiscal 2015 | 10 yen | 20 yen | 30 yen | 25.6% | 30.4% |

| Fiscal 2014 | 8 yen | 17 yen | 25 yen | 27.7% | 27.7% |

| Fiscal 2013 | 7 yen | 14 yen | 21 yen | 31.4% | 31.4% |

| Fiscal 2012 | - | 18 yen | 18 yen | 74.0% | 74.0% |

| Fiscal 2011 | 12 yen | 20 yen | 32 yen | 46.9% | 46.9% |

| Fiscal 2010 | 12 yen | 20 yen | 32 yen | 35.9% | 35.9% |

| Fiscal 2009 | - | 32 yen | 32 yen | 28.9% | 28.9% |

*No interim dividend was distributed in fiscal 2009 — the Company's first fiscal year — because the books for this inaugural term had not yet closed. The year-end dividend included a 5 yen per share bonus.

Share Repurchase

| Share repurchase period | Total number of shares acquired | Aggregate acquisition amount |

|---|---|---|

| May 9, 2025 - December 23, 2025 | 8,656,200 shares | 41,999,758,225 yen |

| May 9, 2024 - June 17, 2024 | 2,216,200 shares | 6,499,783,213 yen |

| February 5, 2024 - February 5, 2024 | 6,766,000 shares | 22,422,524,000 yen |

| May 10, 2023 - July 12, 2023 | 1,678,900 shares | 6,199,897,691 yen |

| May 12, 2022 - December 19, 2022 | 8,223,000 shares | 29,999,853,433 yen |

| May 13, 2021 - September 2, 2021 | 1,430,400 shares | 4,470,000,000 yen |

| May 13, 2020 - May 14, 2020 | 1,395,600 shares | 3,029,847,600 yen |

| May 14, 2019 - July 31, 2019 | 749,800 shares | 4,139,444,981 yen |

| May 11, 2018 - July 30, 2018 | 809,100 shares | 4,209,858,472 yen |

| May 11, 2017 - July 18, 2017 | 908,300 shares | 2,859,885,484 yen |

| May 11, 2016 - June 23, 2016 | 834,900 shares | 2,099,829,682 yen |

| October 30, 2015 - December 9, 2015 | 540,400 shares | 1,599,738,482 yen |

| May 12, 2014 - May 29, 2014 | 311,800 shares | 499,954,400 yen |

Cancellation of Treasury Stock

| Date of cancellation | Total number of shares to be cancelled |

Percentage of issued shares before the cancellation |

|---|---|---|

| February 27, 2026 | 7,833,411 shares | 3.3% |

| March 27, 2024 | 8,212,000 shares | 3.4% |

| February 28, 2023 | 6,715,483 shares | 2.7% |

| September 28, 2021 | 12,206,400 shares | 4.6% |

Preferential Treatment for Shareholders Program

The Company does not have a preferential treatment for shareholders program.