Medium-term Strategies

Medium-Term Management Plan (2021-2023)

Position of Medium-Term Management Plan (2021–2023)

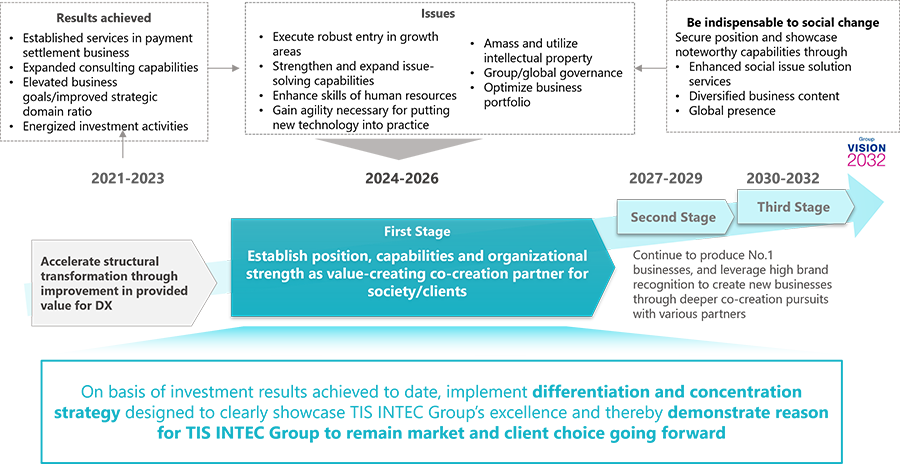

Medium-Term Management Plan (2021–2023) is the second step on our journey toward Group Vision 2026.

The medium-term management plan will be a time to enhance our value chain by improving the value provided in DX services, and by promoting further structural transformation, we will grow the Group and be better positioned to address social issues.

For details about Group Vision 2026, go to Group Vision .

Slogan

Our slogan is "Be a Digital Mover 2023, " which is based on the mission—To color the future as a mover using digital technology—as described in OUR PHILOSOPHY, the Group's basic philosophy.

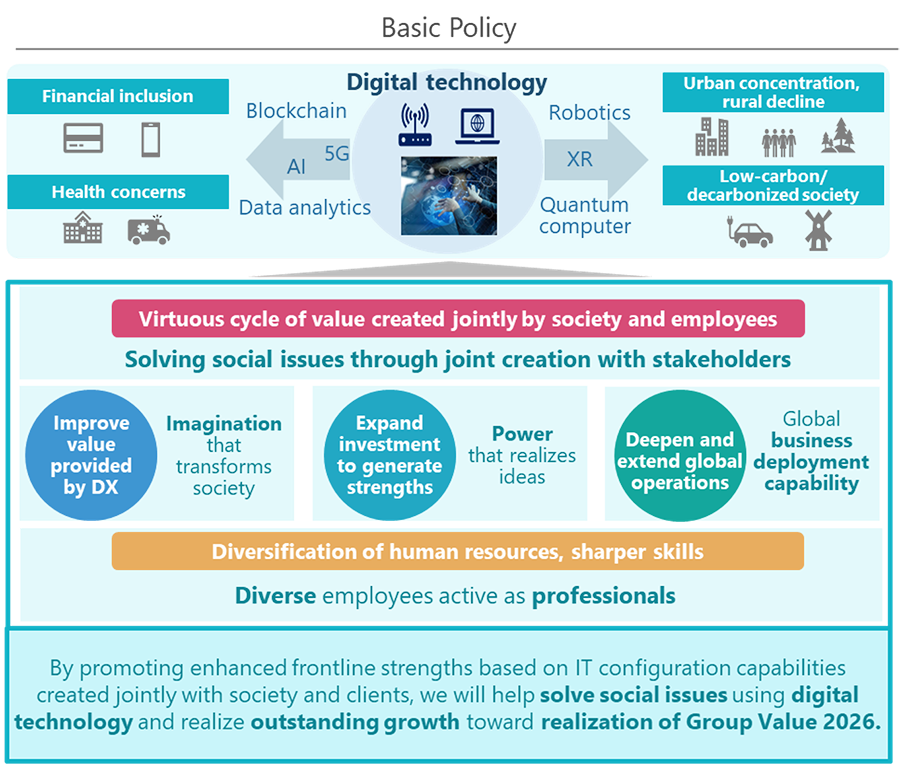

Basic Policies and Priority Strategies

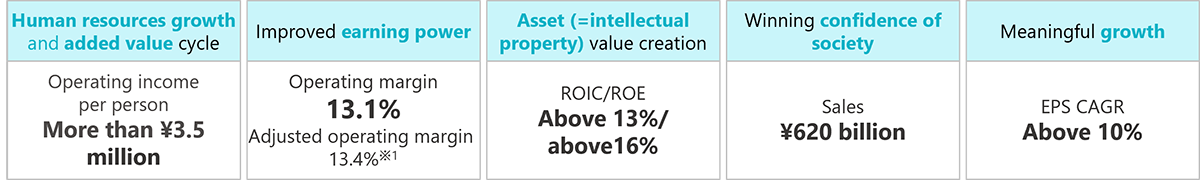

Key Performance Indicators

The TIS INTEC Group promotes sustainability management conscious of sustainable growth and keen to create social value and economic value drawing on business activities to solve social issues. With this in mind, TIS set key performance indicators—net sales of ¥500 billion, operating income (operating margin) of ¥58 billion (11.6%), EPS growth (CAGR) exceeding 10%, a strategic domain ratio of 60%, and sales of ¥50 billion from social issue solution services—in Medium-Term Management Plan (2021–2023) from the perspective of achieving sustainable improvement in corporate value, driven by business growth and enhanced profitability through progress in structural transformation highlighting four strategic domains.

*1 Sales from services that provide solutions to social issues of concern to TIS INTEC Group. Manage business growth as part of strategic domain operations

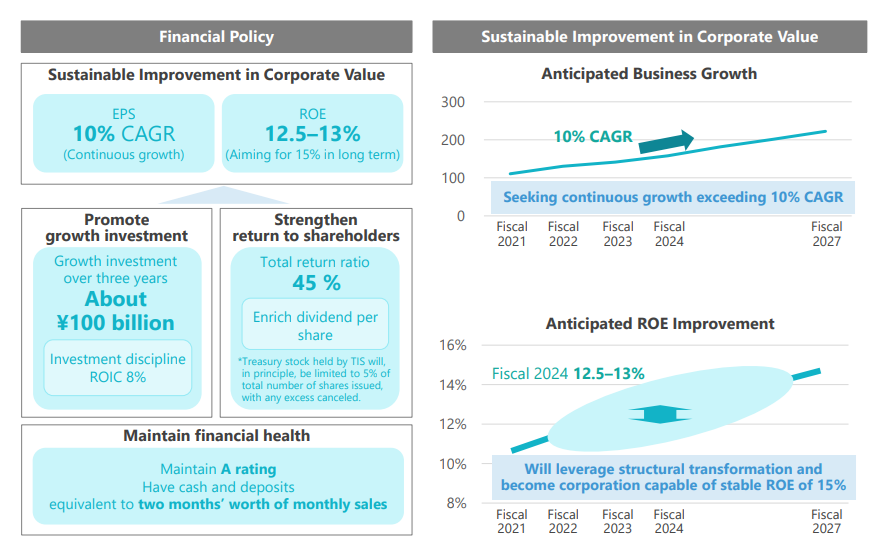

Financial Policy

The TIS INTEC Group has always promoted management from a capital cost perspective and strives to continuously generate returns exceeding capital costs. Toward this end, the Group seeks to build an appropriate capital structure and boost capital efficiency, underpinned by a good balance of measures to support growth investment, ensure a sound financial footing and strengthen return to shareholders.

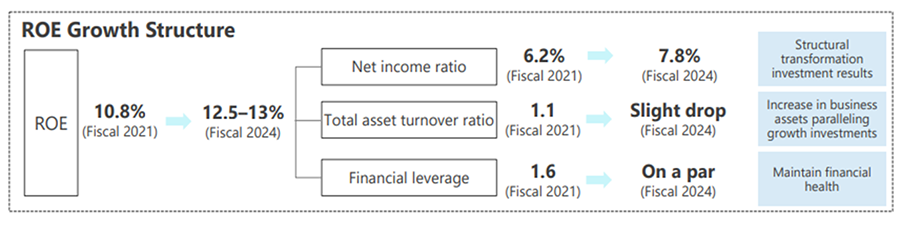

For ROE, our target is between 12.5% and 13% by fiscal 2024, ending March 31, 2024, through continuous growth in EPS. Looking long term, we will leverage structural transformation to become a company capable of achieving stable ROE of 15%.

Numerical Targets

| Consolidated | Net Sales | Operating Income (Operating Margin) |

Net Income Attributable to Owners of the Parent Company |

|---|---|---|---|

| Fiscal 2024 ending March 31, 2024 (estimate) |

¥500.0 billion | ¥58.0 billion (11.6%) |

¥39.0 billion |

| (For reference) Fiscal 2021, ended March 31, 2021 (actual) |

¥448.3 billion | ¥45.7 billion (10.2%) |

¥27.6 billion |

Basic Policy on Return to Shareholders

The Company regards the return of profits to shareholders as a key management decision and has adopted a basic policy of maintaining sufficient internal reserves required for business growth from a medium- to long-term management perspective, while continually paying a stable dividend in consideration of its consolidated financial results.

Through the medium-term management plan(2021-2023) , Balancing efforts to leverage growth investment, maintain financial health and strengthen return to shareholders, TIS will lay the groundwork for an increase in the total return ratio yardstick to 45%, from 40%, and constantly enrich dividends per share.

In so doing, the Company will raise shareholder engagement.

*Total return ratio: Ratio of dividends and treasury stock buybacks to income attributable to owners of the parent

For details on return to shareholders, go to Shareholder Return .