Top Message (Integrated Report Version)

Determined to improve corporate value

Path to increasing corporate value and realization of long-term vision

Understanding the business environment to transform changes into new strengths

Q.How do you see the current business environment, and what’s in store going forward?

The current business environment is characterized by unprec - edented changes and an extremely high degree of uncertainty. The economic outlook, at home and abroad, remains difficult to predict due to such factors as fluctuating interest rates and exchange rates, heightened geopolitical risks, and inflationary pressures. In Japan, structural issues, namely labor shortages and rising commodity prices, are becoming more apparent and having significantly more of an impact on corporate activity. I sense that the IT industry is at a major turning point—more consequential than anything we’ve experienced before— fueled by rapid progress in technology, especially generative AI, as well as industry restructuring, intensifying rivalry between companies, and increasingly fierce competition for talent. We, as an industry, are at a point where competitive - ness and the ability to adapt flexibly to changes are being tested more than ever before.

Corporate management today must resist viewing changes in the external environment as risks, and instead recognize that changes are potential opportunities, and actively capitalize on such changes to achieve growth. I believe the question of how to deal with changes is one that business leaders have always grappled with, and in my mind, the issues of today aren’t necessarily more difficult than at any other time. The difference might be, however, in the accelerated pace of change and inherent complexity. I want TIS to be a company that responds flexibly to change, and thereby continue to evolve.

IT is now an essential part of social infrastructure and an important tool for solving social issues as well as for strength - ening our clients’ competitiveness and transforming business operations. Even temporary economic uncertainty is unlikely to significantly alter IT investment levels. Indeed, based on comments made during meetings with many client company executives, I believe strategic investment will continue as companies seek to improve added value, streamline operations and hone a sharper competitive edge. The TIS INTEC Group is determined to provide value by consistently maximizing the power of IT as a partner supporting the transformation of client companies and wider society.

Navigating uncertainty to realize higher corporate value

Q.What is the significance behind the stated goal now of improving corporate value based on PBR?

The results of the first year of our Medium-Term Management Plan (2024–2026) reminded me that hitting financial targets doesn’t necessarily guarantee higher corporate value. Even if we post performance results in line with estimates, market valuation won’t chart the upward path we hope for unless market watchers are convinced of our future prospects and solid potential for sustainable growth. In fact, I feel that the first year of the plan saw more comments than ever before from shareholders and investors asking for clearer explanations about certainty of growth and future profitability.

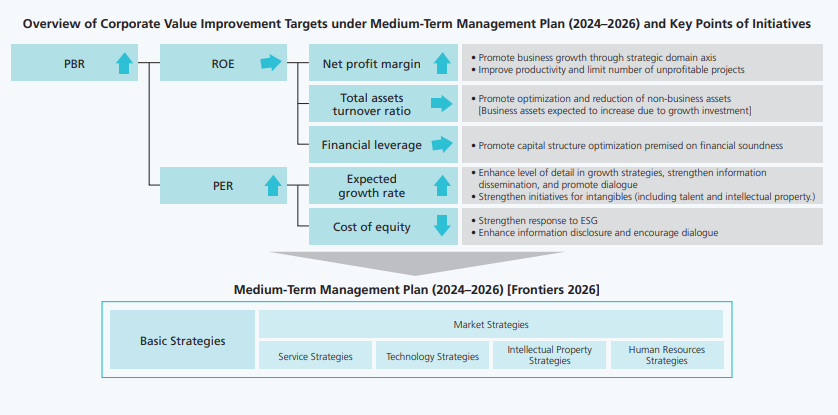

Against this backdrop, the decision was made to empha - size price-to-book ratio (PBR) as an indicator for visualizing corporate value on a groupwide basis and promoting a shared understanding of corporate value within the Group and among outside stakeholders, such as investors and sharehold - ers. PBR is a metric used to gauge future ability to create value and looks beyond a company’s net assets, including invisible value, such as intangible assets. It’s not just a measure of management results but also a measure of a company’s social and long-term significance.

With that in mind, we systematically broke down the content of each strategy in the Medium-Term Management Plan (2024–2026) using a logic tree, based on the components of PBR, and outlined measures accordingly. For return on equity (ROE), one of the two major components, we are already taking steps, including share buyback of an amount deemed necessary to achieve our medium-term management plan targets, based on current status after the first year of the plan and simulations providing a glimpse into our future. For price-earnings ratio (PER), the other major component, we are focusing on how to respond to expectations for growth.

It’s important to note that PBR is based on multiple, intricately intertwined factors, and a single measure to enhance PBR and thus corporate value won’t bring about significant change. For precisely this reason, we had to clarify which factors to emphasize and what approach to take so that underlying measures to boost corporate value would be understood internally and externally.

I believe that by adding structural perspective to previous efforts, we have become better able to address the issue of corporate value in a more fundamental way. This structure will support concrete initiatives that lead to results, which will fuel progress toward the targets stated in our Medium-Term Management Plan (2024–2026) and ultimately enable us to realize Group Vision 2032.

A path to the future built on growth strategy hinging on three pillars of business

Q.What are your thoughts on promoting expectations of growth to improve PER?

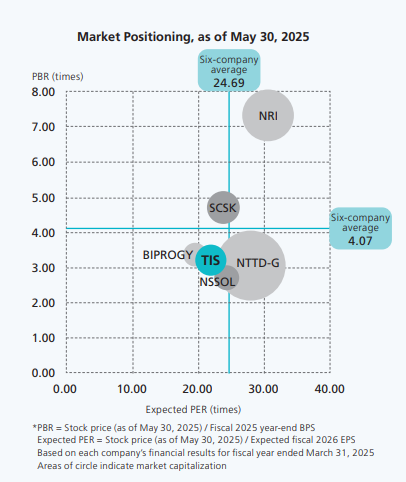

PER is an indicator of market expectations relating to a company’s future profitability. Our consolidated PER is at present relatively low compared with that of major rivals as well as the industry average based on these companies, and we know we must do more to encourage the market to see us as a company with strong growth prospects and the ability to consistently generate profits commensurate with strong growth.

To meet expectations, we identified three pillars of support for TIS’ growth strategy—enhanced profitability of the IT & Business Offering Service (IOS), an emphasis on the modernization business, and further expansion of global activities—and we’re steadily implementing initiatives for success.

Regarding IOS, we will link and restructure businesses launched so far, focusing on PAYCIERGE, to address client needs and turn our responses into high-value-added services. Our aim is to achieve both improved profitability and sustainable growth, and to strengthen the value of our services from a client perspective.

In the field of modernization, we won’t stop with services for short-term projects, such as legacy system renewal, but instead, build relationships of trust with our clients as a strategic partner and create additional business opportunities through continued business interaction. We will position modernization as a driver of stable growth by reinforcing our ability to provide proposals that go beyond post-project maintenance and business reform support.

And in global business pursuits, sales are currently limited in scale. However, the potential for operations in overseas markets to grow into a future source of revenue is expanding, fueled by economic growth and heightened demand for technology, especially in Southeast Asia. We remain committed to building relationships of trust with local communities and developing a solid business base in these markets, with efforts guided by a long-term perspective that will set the stage for future success.

These three pillars are central to the TIS INTEC Group’s medium- to long-term growth story. We will communicate not only quantitative targets but also our desired destination and how we will get there in a concrete and credible way to gain the trust of the market, which will lead to higher PER.

Results achieved in first year of the medium-term management plan, and future prospects

Q.What was the most satisfying result from the first year of the medium-term management plan?

Fiscal 2025 was a year in which we exceeded targets, in terms of performance, and made progress on other fronts that will form a springboard for our next stage of growth. Of note, we definitely capitalized on IT investment demand, especially requests for legacy system modernization and approaches to deal with the end of SAP ERP maintenance and standardization of systems used by local governments in Japan.

I am most encouraged by solid gains made in the field of modernization. Modernization services, important as a process directly linked to expansion of our client base, are integral to the success of our growth strategy. With the establishment of a service structure and enhanced proposal-making capabilities, we are seeing substantial progress in building modernization services into a driver of growth, substantiated by orders from new clients in the financial sector and other sectors as well.

Xenlon Modernization Service, developed in-house, has earned high marks as a service that enables safe and reliable modernization in a short timeframe. The conversion rate for Xenlon-driven migration from legacy languages, such as COBOL, to Java, is nearly 100%, but Xenlon does much more, boasting the ability to automatically generate source code for high maintainability after conversion and ensure stable operational performance. In addition, TIS has built an extensive track record in project management and applies accumulated knowhow to support the creation of IT environments fine-tuned to client needs. This comprehensive capability is highly regarded, and we are seeing a marked increase in the number of clients who say, “We trust TIS to get the job done right.”

Modernization is not just about updating legacy systems. It’s a decision-driving catalyst for client-side digital transformation (DX). Amid an accelerating shift toward DX among companies and local governments, we will utilize modernization as a gateway to build medium- to long-term relationships of trust with clients and establish ourselves as a strategic partner to each one.

Issues that have emerged, and down-to-earth responses

Q.What challenges does TIS face in achieving its medium-term management plan targets, and what steps are being taken to mitigate these challenges?

As I mentioned earlier, the medium-term management plan got off to a good start in terms of performance, but looking ahead to sustainable growth, there are still issues that require attention. Reducing the number of unprofitable projects and enhancing IOS profitability are two particularly important issues as resolution is connected to an improvement in corporate value.

On the issue of unprofitable projects, quantitatively, the number is falling. But on a value basis, we haven’t been able to break below the ¥1 billion level we set as a target. To this end, we are reinforcing quality control measures across the entire group and are committed to early detection and early response. We are taking a multifaceted approach that includes heightened monitoring groupwide, thorough adherence to rules on project management, and assignment of experts to project teams. That said, many unprofitable projects cannot be prevented by systems and specifications alone. Indeed, a large part of the problem with unprofitable projects stems from on-site decisions and actions by individuals so it’s imperative that quality control is understood, takes root and becomes firmly entrenched in project processes. Going forward, we aim to reduce the occurrence of unprofitable projects through being meticulous and implementing initiatives to raise awareness of quality control.

Meanwhile, IOS is taking longer than expected to get fully on track, and although the business is moving in a positive direction, there’s still room for improvement in terms of profitability. To date, TIS has opted for proactive investment and a process of repeated trial and error to respond to the diverse needs of the Group’s client base. Consequently, the emphasis has been on PAYCIERGE, the digital payment platform at the core of IOS, with updates to the service menu, including a credit card processing service, and a menu that covers all aspects of money flow.

Looking ahead, we will seek to find a balance with profitability by linking services initially launched individually to meet specific client needs and fine-tuning them to provide even more cutting-edge value. In addition, we will maintain a holistic view toward investments, including M&A opportunities, and concentrate the application of capital allocation into areas that will generate synergies and ultimately enhance IOS profitability.

We will tackle these challenges with determination and move onto a true growth trajectory by applying one down-toearth initiative at a time.

Strengthening intangible assets that support sustainable growth

Q.What steps are being taken to strengthen intangible assets so that TIS achieves its Medium-Term Management Plan (2024–2026) targets?

Human resources are the most important management asset we have for achieving sustainable growth. We constantly invest in intangible assets, particularly our people, because human resources are the source of our competitive advantage and vital to corporate growth.

An important asset within human capital—a value that benefits TIS and the whole TIS INTEC Group—is what I call “buddy power,” essentially “strength as a team.” The term embodies a partnering attitude, a willingness to work closely with clients to find solutions to issues of concern. Within the Group, knowledge sharing and unstructured collaboration across operating segments and business domains is increasing, and I firmly believe that buddy power will become an intangible asset that symbolizes the uniqueness of the TIS INTEC Group and serves as a driving force for sustainable growth.

Buddy power applies not only to relationships within the Group but also to relationships with clients. How do we increase the number of clients who participate in projects like members of a team? It’s a question that needs an answer. TIS’ growth depends on increasing the number of clients who subscribe to the teamwork idea. I fervently believe that the expansion of partner-style relationships, where clients are active in projects and work with us to overcome challenges, is the essence of creating corporate value.

This perspective guides us in strengthening investment in human resources along three axes—the meaning of work, the working environment, and compensation—to further increase the added value of our people. In addition, since April 2025, the division manager of the Corporate Planning SBU also serves as division manager of the Human Resources SBU, creating a system for promoting management strategies and human resources strategies in an integrated manner.

Of course, employees don’t develop skills or acquire knowledge simply because systems and environments exist for that purpose. To empower employees to embrace challenges, management must lead by example in facing difficult circumstances and constantly demonstrate a commitment to persevere. Growth doesn’t come by pushing someone to take on an impossible task but rather by enabling that person to accumulate experience, similar to “pressure training,” a method used to equip athletes with the mental agility and physical strength to perform under pressure by, for example, setting realistic stretching goals that gradually lead to enhanced capabilities. At TIS, we seek to promote a culture of daily dialogue, support, and empathy that motivates employees to tackle challenges head-on.

The use of cutting-edge technologies, such as generative AI, is also an important initiative. In April 2025, we introduced a companywide promotion system and have been accelerating the use of generative AI in programming and testing processes at development sites. We are also expanding our response to clients seeking to transform business operations by providing high-value-added services that utilize generative AI.

We will maintain steady progress on these measures and initiatives to maximize intangible assets from a medium- to long-term perspective, and reinforce our position as a company capable of sustainable growth.

Defining our future along with our stakeholders

Q.What expectations emerged from dialogue with investors? And is top management ready to meet those expectations?

Through various opportunities for dialogue with shareholders and investors since Medium-Term Management Plan (2024– 2026) was announced, I am aware of the high expectations placed upon the TIS INTEC Group and feel the scrutiny that accompanies expectations. Comments tended to focus on the specifics of our growth strategy and our commitment to medium-term management plan targets, indicating that stakeholders seek validation of the Group’s ability to execute strategies and realize long-term growth.

I think what shareholders and investors really want to know goes beyond a simple update on progress toward numerical targets. They want to know the kind of future we envision for ourselves, our end destination and how we will get there, and whether our picture of the future is realistic, whether we have the wherewithal to succeed. As a top executive, I am acutely aware at all times of the importance of fulfilling commitments, which are, in effect, promises to stakeholders. A manager should always be thinking about the good and the bad, and possess the ability to execute real steps to capitalize on the positive and mitigate the negative. I believe this capacity to recognize problems and possibilities and act accordingly reveals manager integrity.

The road we are traveling toward medium-term management plan targets certainly isn’t smooth. However, we made a commitment—a promise—to stakeholders, and when obstacles appear to block our progress toward targets, we work even harder to reach the next stage. The challenges just make success all the sweeter. I’m confident that we can deliver solid results if we believe in our potential and continue to maximize buddy power.

During my career, I have seen many changes and encountered many stumbling blocks. As someone in a leadership position, I always strive, no matter how difficult a situation may be in the short term, to pursue the path I believe is best in the medium to long term and to never give up. And I have come to realize that working with colleagues to overcome challenges inevitably leads to personal as well as corporate growth.

Going forward, TIS will continue to place importance on this kind of perspective, engage sincerely with all stakeholders, and fulfill its promise to increase corporate value.

September 30, 2025