Working toward Realization of Management Aware of Capital Costs and Share Price

The TIS INTEC Group adheres to management practices that take capital costs and share price into consideration, seeking continuous improvement in corporate value. To this end, as a corporate group, we strive to sustainably generate returns that exceed cost of capital while maintaining a strong focus on capital efficiency.

We balance growth investments, financial soundness and shareholder returns, actively working to optimize our business portfolio and capital structure through enhanced balance sheet management. In addition, we direct concerted effort into reducing cost of capital through proactive information disclosure and ongoing engagement with stakeholders.

(1) Basic Policy

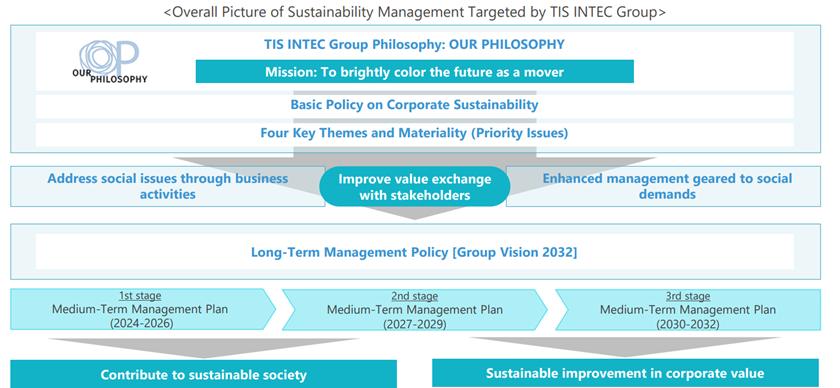

- We seek to contribute to a sustainable society while continuously improving corporate value by promoting sustainability management rooted in the Group’s basic philosophy, “OUR PHILOSOPHY,” and by strengthening the value we create together with our stakeholders.

- To achieve this objective, we established Group Vision 2032, a long-term management policy that provides the foundation for implementing specific strategies and initiatives defined in our medium-term management plan.

(2) Analysis and Evaluation of Current Status

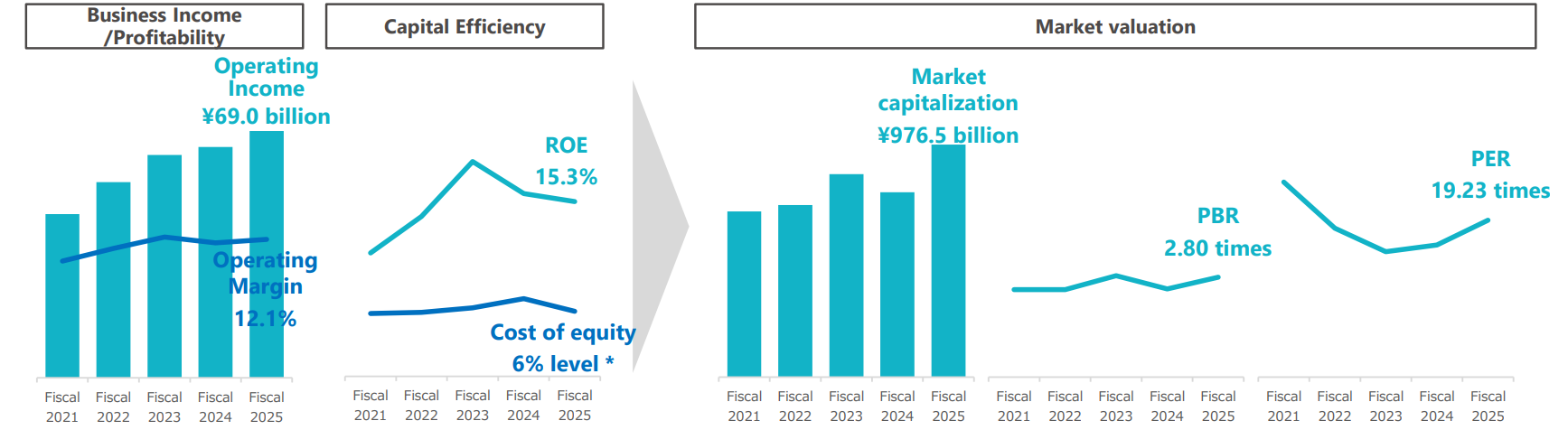

- Promoted measures from both business and financial perspectives. Sustainably generate returns above the cost of capital and, accordingly, improve market assessments.

- However, in order for our corporate value to be fairly reflected in market valuation, we recognize that increasing growth expectations from a medium- to long-term perspective is particularly important.

| Business Income/Profitability | Achieved sustainable business growth and improved profitability even as we aggressively pursue growth investment for the future, including for human resources. |

|---|---|

| Capital Efficiency | In addition to improving EPS through business growth, promote financial measures, including capital structure optimization. ROE exceeded cost of equity. |

| Market valuation | Use active information disclosure and constructive dialogue to improve management practices. Promoted understanding and confidence in management and improved market valuation. |

(3) Overview of Plans and Efforts

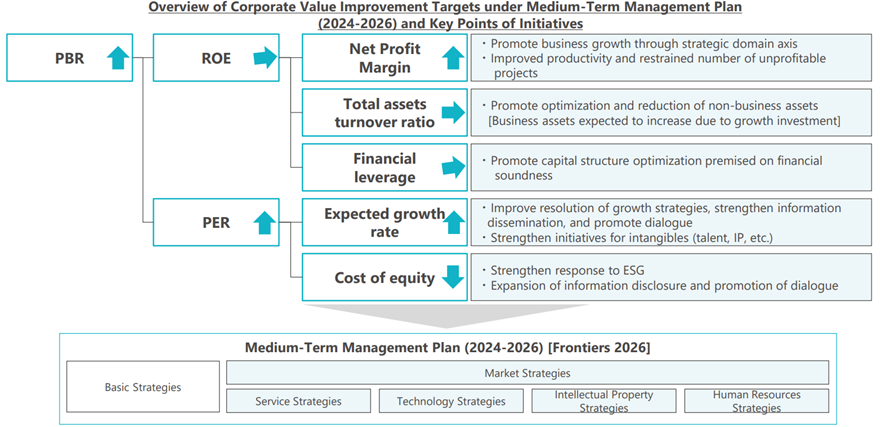

We place a strong emphasis on PBR as an indicator of corporate value. Under Medium-Term Management Plan (2024–2026), we are steadily promoting strategies and initiatives to further improve corporate value and secure appropriate market valuation matched to progress.

For more information on the Medium-Term Management Plan (2024–2026) , please visit.

Briefing Materials for Medium-Term Management Plan (2024-2026)