Corporate Governance

Based on OUR PHILOSOPHY (TIS INTEC Group Philosophy) and Group Vision, we have formulated basic corporate governance policies aimed at improving the Group’s corporate value over the medium and long terms. We are working constantly to enhance corporate governance.

* PDF files must be viewed with Adobe Reader

- Basic Policies on Corporate Governance (as of January 1, 2025)

- Independent Directors/Audit & Supervisory Board Members Notification (Submitted on May 16, 2025)

Basic Policy

TIS will constantly strive to achieve the highest level of corporate governance and will work to maintain and further enhance its approaches to corporate governance.

Management believes that the key to good corporate governance is to ensure transparency and fairness in decision-making processes, make full and effective use of management resources, and raise the integrity of management practices through swift and accurate assessment of situations, from the viewpoint of promoting sustainable corporate growth and boosting medium- and long-term corporate value. Accordingly, management at the Company is committed to upholding good corporate governance in line with the following basic principles.

- To respect the rights of shareholders and to ensure equality.

- To consider the interests of stakeholders, including shareholders, and work with stakeholders in an appropriate manner to achieve stated goals.

- To disclose corporate information appropriately and ensure transparency.

- To engage in constructive dialogue with shareholders based on a medium- to long-term investment perspective.

Compliance with the Corporate Governance Code

TIS complies with all principles of the Corporate Governance Code.

The status of the Company’s responses to each principle of the Corporate Governance Code is described in the Corporate Governance Report.

Corporate Governance Structure

| Form of Organization | Company with audit & supervisory board |

|---|---|

| Chairman of the Board | Chairman |

| Number of Directors | 9, including 3 external directors |

| Director's Term of Office | 1 year |

| Number of Audit & Supervisory Board Member | 5, including 3 external audit & supervisory board members |

| Term of Office for Audit & Supervisory Board Members | 4 years |

| Number of Independent Directors | 6, including 3 external directors and 3 external audit & supervisory board members |

Reason for Selection of Current Corporate Governance Organization

TIS is a Company with an Audit & Supervisory Board, a model chosen for its double-check function through which the Board of Directors oversees the execution of business activities and the Audit & Supervisory Board audits activities to ensure operations are legal and appropriate. In addition, the Company aims to strengthen the supervisory function of the Board of Directors by appointing outside directors with industry- and corporate management-related experience and insight and drawing on advice and recommendations from an independent standpoint to ensure the validity and appropriateness of decision-making by the Board of Directors.

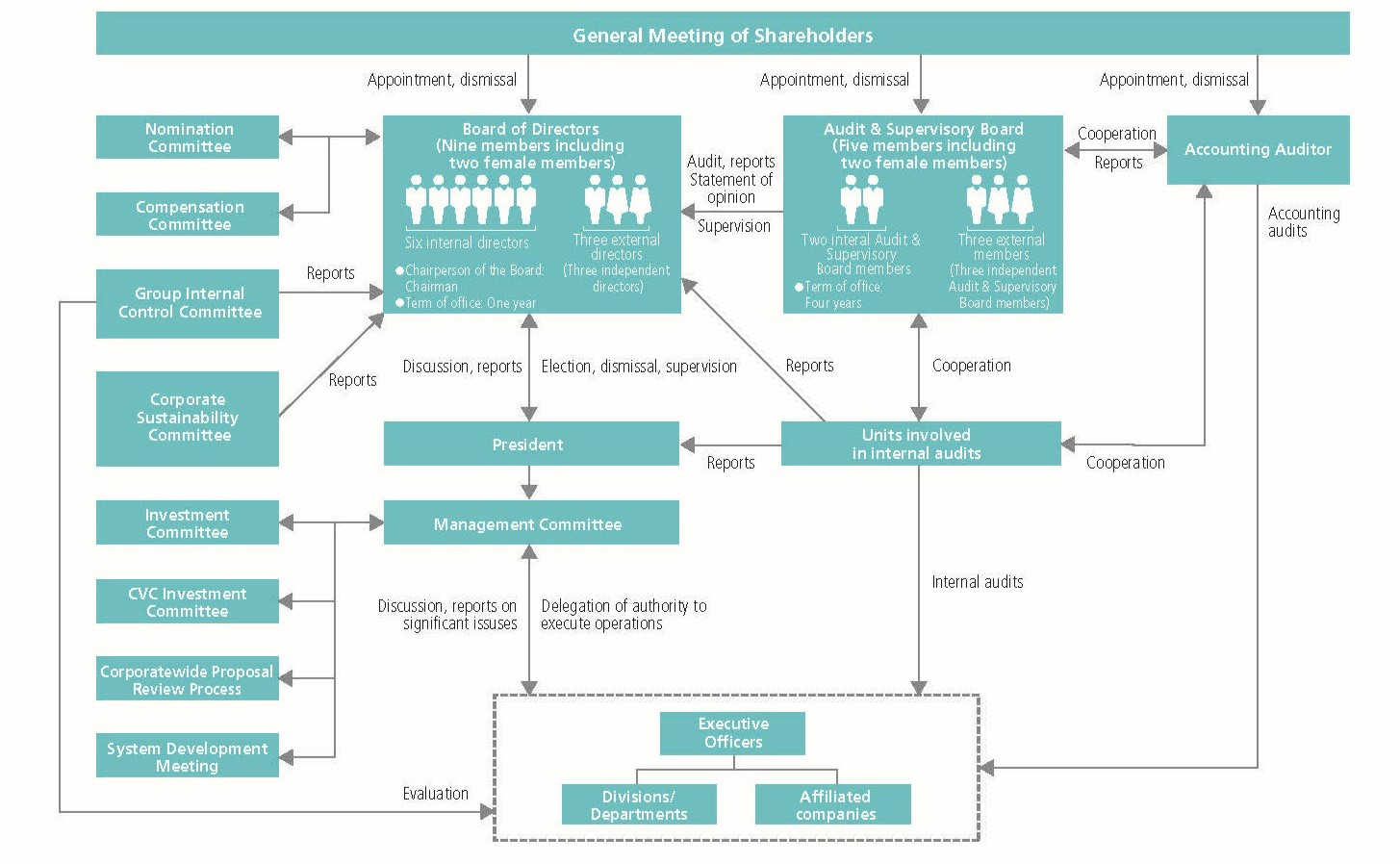

Organizational Chart

| Directors and Board of Directors | As stipulated in its Articles of Incorporation, the Company's Board of Directors will comprise at least three and no more than 15 directors, and to strengthen the supervisory functions of the Board of Directors, a policy has been established that one-third or more of the directors must be independent external directors. At present, three independent external directors have been appointed. In principle, the Board of Directors meets once a month, with additional extraordinary meetings and meetings to exchange opinions held as necessary to enable Directors to make swift and flexible decisions. TIS holds an information meeting once a year to present management direction as well as meetings ahead of Board of Directors' meetings—in principle, once a month—to give external directors and outside members of the Audit & Supervisory Board sufficient background information to participate in discussions. In addition, the Company organizes study sessions with experts—in-house and external—and arranges visits to local Group facilities and offices. TIS also provides support to ensure smooth and proactive discussions at Board of Directors meetings, including by holding informal meetings between external directors and the President, and between external directors and outside members of the Audit & Supervisory Board. |

|---|---|

| Nomination Committee | The Nomination Committee was established as advisory bodies to the Board of Directors to ensure objectivity and transparency in decision-making processes pursuant to appointment of directors and to strengthen the corporate governance structure. The independent outside director chairs the committee, with the majority of members, including the committee chair, being independent outside directors. |

| Compensation Committee | The Compensation Committee was established as advisory bodies to the Board of Directors to ensure objectivity and transparency in decision-making processes pursuant to compensation of directors and to strengthen the corporate governance structure. The independent outside director chairs the committee, with the majority of members, including the committee chair, being independent outside directors. |

| Group Internal Control Committee | The Group Internal Control Committee is charged with promoting various measures to maintain and improve the internal controls of the Company and its subsidiaries, to evaluate the operational status of the internal control systems and to recommend any corrective action to be taken to the Board of Directors, if necessary. The committee, chaired by the TIS President, comprises standing directors, standing Audit & Supervisory Board members, persons responsible for the internal control management, and any person whose attendance is authorized by the committee. |

| Corporate Sustainability Committee | To implement sustainability management, we will identify trends, discuss sustainability-related issues, and indicate the direction and targets of our response. In accordance with these directions and targets, corporate and business department plan and promote measures, and their planning or progress are deliberated by the Management Committee and overseen by the Board of Directors as appropriate. The committee, chaired by the TIS President, Directors, Audit & Supervisory Board Members, Division Manager of corporate planning division, Department Manager of corporate planning Dept, and any person whose attendance is authorized by the committee. |

| Management Committee | The Company has established the Management Committee to deliberate and report on important matters affecting business execution at the Company and the Group as a whole. |

| Investment Committee | The Investment Committee was established to verify/advise on plans for investment projects, monitor ongoing projects and assess whether to continue them with the aim of minimizing related risks and earning higher returns on investments. |

| CVC Investment Committee | The Company makes corporate venture capital (CVC) investments and enhances alignment with venture capital companies in the form of open innovation in order to (1) create new business, (2) expand existing businesses, and (3) promote business collaboration with customers. For such investments, the CVC Investment Committee decides whether or not to execute an investment and monitors the executed investment. |

| Corporate-wide Proposal Review Process | For large-scale projects to be addressed by the Group as a whole, the Corporate-wide Proposal Review Process was implemented to review drafts prior to actual proposals to customers, in order to detect and reduce risks as early as possible. |

| System Development Meeting | System Development Meetings are held to identify potential risk factors in large-scale projects to be undertaken by the Group as a whole, to develop measures to prepare for risks, to resolve issues before they materialize, and to terminate any project with losses. |

| Audit & Supervisory Board Members and Audit & Supervisory Board | The Audit & Supervisory Board comprises five auditors (of which three are external auditors). Each auditor will perform audits of directors' business execution in accordance with the audit & supervisory policies established by the Audit & Supervisory Board. In addition, the Company works closely with its financial auditors, exchanging information and sharing opinions on a regular basis in addition to receiving the annual financial audit plan and reporting on results of financial audits from Ernst & Young ShinNihon LLC, with which the Company has entered and auditing contract. Furthermore, the Audit & Supervisory Board receives the audit reports of the auditing department and exchanges opinions on a regular basis. |

Executive Officer System

The Company has adopted an executive officer system to accelerate management decision-making and supervisory functions of the Board of Directors. Directors delegate business execution to Executive Officers, and these Executive Officers provide specific direction, orders, and supervision to each business unit head.

Viewpoint regarding Composition of Board of Directors

The Board of Directors shall be composed of no more than 15 directors, at least one-third of whom shall be independent external directors. The Board of Directors recognizes its fiduciary responsibility toward shareholders, supervises management strategy, management plans and other important decision-making and business execution of the Company, as prescribed by laws and regulations, the Articles of Incorporation and Company regulations, and bears a responsibility to ensure sustainable growth and enhance medium- to long-term corporate value. In the case of directors that constitute the Board of Directors, after engaging in discussion at meetings of the Board of Directors, the Company shall nominate persons who have extensive experience, strong insights and a high level of specialization that is appropriate for these obligations based on the election criteria prescribed by the Company.

Summary of Results of Analysis and Evaluation of Effectiveness of Board of Directors

TIS strives for the best corporate governance for its sustainable growth and improvement of corporate value and works continuously to make improvements in that area. Since fiscal 2016, ended March 31, 2016, the Company has evaluated the effectiveness of the Board of Directors each fiscal year with the aim of identifying issues and areas for improvement and linking them to initiatives to improve the Board's effectiveness. Currently, the Company makes an effort to strengthen the monitoring function of the Board of Directors to speed up and streamline decision making and business execution of the Group. For the fiscal 2025 evaluation, all directors and Audit & Supervisory Board members were given a questionnaire to be submitted anonymously. The questionnaire asked them to conduct a comprehensive self-evaluation and self-analysis of the priority themes for further enhanced corporate governance as well as the operation of the Board of Directors. Individual interviews were also conducted, and the Board of Directors held discussions based on the results of those interviews. The method and results of the evaluation are described below.

1. Method

TIS distributed a questionnaire regarding the effectiveness of the Board of Directors to all directors and the Audit & Supervisory Board members and obtained responses. In addition, personnel of its administrative office conducted interviews with all directors and the Audit & Supervisory Board members. The Company's Board of Directors then used these results to analyze and evaluate the Board's effectiveness of the Board of Directors. Note that TIS conducted this effectiveness evaluation and discussed action policies/suggestions to improve effectiveness going forward based on advice and verification by external experts.

2. Coverage of evaluation

The fiscal 2025 evaluation was conducted with a focus on the status of initiatives for the priority themes for further enhanced corporate governance in the fiscal 2026 onward, in addition to the operation of the Board of Directors in the fiscal 2025.

-

(1) Operation of the Board of Directors

From the perspective of further enhancing monitoring, we confirmed the appropriateness of the viewpoint and the frequency of selecting and monitoring agenda items, the frequency and duration of meetings, the explanation about meeting agenda, materials provided and the amount of information contained, etc. -

(2) Priority themes for further enhanced corporate governance

We confirmed the appropriateness and sufficiency for the following themes:- Board of Directors' supervisory function

- Expected roles for Directors

- Delegation of authority to execution side

- Composition of the Board of Directors

- Ideal state and functioning of advisory committees (Nomination and Remuneration)

- Coordination between the Board of Directors and auditing bodies

- Dialogue with shareholders, and other themes.

3. Results of analysis and evaluation of effectiveness of the Board of Directors

In fiscal 2025, the Board of Directors formulated an annual schedule and reviewed the delegation of authority based on the issues, "preparing agenda items as a monitoring model" and "defining criteria for delegating authority and expected roles for Directors," identified in the previous fiscal year. As a result, in the questionnaires and interviews, the self-evaluation indicated that there was no matter inadequate/insufficient as initiatives for the operation of the Board of Directors and further enhanced corporate governance. Meanwhile, the Board of Directors is advancing the evolution of the monitoring model for the Company's sustainable growth and medium- to long-term corporate value improvement, and has recognized the need for further evolution, such as presenting monitoring points from the supervisory side to the execution side in order to realize the strategy, particularly with regard to monitoring execution in medium- to long-term strategy implementation.

-

(1) Evaluation for the operation of the Board of Directors

- Clarifying the code of conduct for running the Board of Directors meetings has helped to align the perspective of the Board and stimulate discussion. In addition, explanation about meeting agenda, and materials provided and amount of information contained were almost adequate.

- On the other hand, the evaluation found room for improvement in the regular monitoring of key strategies (business portfolio, M&A, ERM, human resources, finances, etc.) based on the medium-term management plan, which is the basic policy that steers the company. The evaluation also found that it is necessary to provide external directors with more opportunities to receive information about the competitive environment and the latest technologies, which is necessary for them to deepen their understanding of the Company.

-

(2) Evaluation for the priority themes for enhanced corporate governance

- In light of the above issues, it is necessary to continue to consider further strengthening governance across the Group regarding human capital, financial capital, and other capital related to management, and to consider revising the composition of the Board of Directors (in terms of the balance of internal and external members and their diversity) to be more suitable for monitoring them.

- Regarding governance in terms of nomination and remuneration, it is necessary to continue to verify and improve these processes, particularly regarding the nomination governance by the Nomination Committee, which is of high importance.

4. Responses based on analysis and evaluation

In light of the results of the fiscal 2025 evaluation, TIS has classified its initiatives addressing the operation of the Board of Directors and priority themes for enhanced corporate governance into short-term category and medium- to long-term category, and will work on them step by step from fiscal 2026 on an ongoing basis.

<Short-term initiatives>

In fiscal 2026, we will improve the management of the Board of Directors with regard to the following themes:

- When considering the agenda for the Board of Directors meeting, clarify the targets of monitoring, review the items to be reported from the executive side, and request and establish initiatives for business execution

- Enhance the provision of information on changes in the business environment, technology trends, etc. to external directors based on recent changes in the environment

<Medium- to long-term initiatives>

TIS will continue to consider the following themes for the strengthening of the monitoring board function aiming at further improving the effectiveness of the Board of Directors.

- Strengthening the Board of Directors' monitoring of key strategies (business portfolio, M&A, ERM, human resources, finance, etc.) based on the medium-term management plan

- Board of Directors Composition and Skills Matrix

- Enhancement of nomination and remuneration governance (verification and enhancement of processes)

- Strengthening of business execution structure (further strengthening of governance across the Group)

Policy and Procedures for Election, dismissal, and Nomination of Directors, etc.

In nominating candidates for directors, audit & supervisory board members and executive officers, the Board of Directors will nominate persons with abundant experience, a high level of insight and advanced specialization based on the following election criteria that make them suitable as directors or audit & supervisory board members in order to realize effective corporate governance and contribute to the sustainable growth of the Company as well as the enhancement of its medium- to long-term corporate value while also considering aspects of diversity such as gender, internationality, career and age.

If a situation arises where a management executive should be dismissed, the Board of Directors shall determine a dismissal proposal. However, the dismissal of a director shall be conducted in accordance with the Companies Act and other relevant provisions.

Reason for Election of Directors and Audit & Supervisory Board Members

- Directors

| Toru Kuwano | After assuming the office of President and Representative Director of the Group company, Mr. Kuwano was appointed as a Director of the Company in June 2013 and President and Representative Director in June 2016. Since April 2021, he has assumed the office of Chairman and Director of the Company. He has a wealth of experience and knowledge about the Company's and its Group's business, as well as in business administration. Since April 2021, he has also assumed the position of Chairman and Director as a non-executive Director, in order to realize fair management supervision. He has promoted a stronger and more effective corporate governance structure and worked toward the sustainable growth and increase in the medium- to long-term corporate value of the Company. He was appointed as a Director since he is highly expected to continue to fulfill the duties of significant decision-making for the Company's Group as well as the administration and oversight of business management. |

|---|---|

| Yasushi Okamoto | Mr. Okamoto served as Senior Managing Executive Officer and Division Manager of the planning and development department of industrial systems from July 2016, and as Director from June 2018, after having been engaged in corporate business in the corporate planning department of the Company for many years. He was appointed to the office of President and Representative Director in April 2021. Based on these experiences, he is a person who can exert leadership to further promote the sustainable growth and increase in corporate value of the Group through the steady implementation of the current Medium-Term Management Plan (2024-2026). He was appointed as a Director since he is highly expected to fulfill the duties of significant decision-making for the Group and oversight of business management. |

| Shinichi Horiguchi | Mr. Horiguchi has been engaged in finance/credit card business for many years, and has served as General Manager of the Financial Systems Planning and Development Department for financial systems as Managing Executive Officer of the Company since April 2017. He was appointed to the office of Director in June 2023 and the office of Representative Director in April 2024. Based on these experiences, he was appointed as a Director since he is highly expected to promote the current Medium-Term Management Plan (2024-2026), and fulfill the duties of significant decision-making for the Group and the oversight of business management. |

| Kiyotaka Nakamura | After assuming the position of Executive Officer, Mr. Nakamura was involved in corporate operations and the payment business in the corporate planning department. As Managing Executive Officer since April 2018 and Senior Managing Executive Officer since April 2021, he has contributed to the business restructuring of the global business, with a focus on business expansion in the Offering Service Business. Based on these experiences, he was appointed as a Director since he is highly expected to promote the current Medium-Term Management Plan (2024-2026) for further business expansion, and fulfill the duties of significant decision-making for the Group and the oversight of business management. |

| Shuzo Hikida | Mr. Hikida is engaged in business activity to create strategic informatization directly connected to business strategy of top-class companies in the industry at INTEC Inc., one of our major group companies, to establish the revenue base of the network & outsourcing business operation and create new services. Also, he was appointed as director and executive vice president of the said company in April 2023 and as President and Representative Director of the said company in April 2024. He was appointed as a Director since he is highly expected to promote the current Medium-Term Management Plan (2024-2026) at the said company to play a sufficient role in supervision of decision-making on significant matters and the oversight of execution of business management for the Group based on his experiences. |

| Akira Makado | Mr. Makado was engaged in business related to corporate operations such as finance and corporate planning for many years at INTEC Inc., the Company's major subsidiary, where he gained extensive experience and knowledge in fund raising and fund management. He was appointed Executive Vice President and Director of INTEC Inc. in April 2023 and Representative Director and Executive Vice President and Director of INTEC Inc. in April 2024, where plays a key role in governance, including overseeing all of INTEC Inc.'s corporate divisions. Based on these experiences, he was appointed as a Director since he is highly expected to promote the current Medium-Term Management Plan (2024-2026) at INTEC Inc., and fulfill the duties of significant decision-making for the Group and the oversight of business management. |

| Naoko Mizukoshi | Ms. Mizukoshi is a qualified lawyer and has a wealth of professional knowledge of, and experiences in, intellectual property, ICT and international transactions. Since assuming the office of External Director of the Company in June 2018, she has given advice and suggestions from an independent perspective by utilizing these experiences and expertise in the Company's business to ensure that the decisions to be made by the Company's Board of Directors will be reasonable and appropriate. She is highly expected to be a person who will continue to contribute to the increase in corporate value and enhancement of the corporate governance of the Company. Since June 2024, she has acted as Chairperson of the Nomination and Remuneration Committees which are voluntary advisory bodies to the Board of Directors, and fulfills an important role in the deliberation and advice to the Board of Directors on the nomination and remuneration of directors, etc. in response to the consultation of the Board of Directors. Therefore, she was appointed as an External Director since she could discharge duly the duties of External Director. |

| Junko Sunaga | Ms. Sunaga has worked in the semiconductor business, with a focus on mobile phones, and in April 1997 joined the Japan arm of Qualcomm (USA), a leading company in the mobile communications industry, as its first employee. Since April 2018, she has been President and Representative Director of Qualcomm Japan, Inc., where she has achieved successful results in expanding the domestic semiconductor business. She has given advice and suggestions from an independent perspective by utilizing these experiences and expertise in the Company's business to ensure that the decisions to be made by the Company's Board of Directors will be reasonable and appropriate. Therefore, she was appointed as an External Director as she is judged to be a person who will continue to contribute to the increase in corporate value and enhancement of the corporate governance of the Company. |

| Mitsuhiro Furusawa | Mr. Furusawa, having experienced being Vice-Minister of Finance for International Affairs and Deputy Managing Director of the International Monetary Fund (IMF), has broad insight into fiscal and monetary policy as a government official and a global perspective gained as a senior executive at an international organization. We expect him to contribute to the enhancement of the corporate governance of the Company by giving advice and suggestions from an independent perspective to ensure that the decisions to be made by the Company's Board of Directors will be reasonable and appropriate. Moreover, although he has not participated in corporate management in any manner other than as an external officer, he was appointed as an External Director as it is considered that he will be able to utilize his extensive experience and knowledge to appropriately perform the duties of an External Director, thereby improving the Company's corporate value and deepening and expanding global management. |

- Audit & Supervisory Board Members

| Makoto Tsujimoto | Mr. Tsujimoto has abundant experience and knowledge of systems and center operations, which form the foundation of the service business of the Company. In addition, he has knowledge of corporate management as he has served as representative director of QUALICA Inc., a consolidated subsidiary of the Company, since April 2019. He was appointed as an Audit & Supervisory Board member because it is expected that he can perform accurate and fair monitoring and oversight functions for the Company's business contents and internal audits as well as the execution of business by the directors of the Company by taking advantage of these experiences. |

|---|---|

| Hideki Kishimoto | Mr. Kishimoto has experience in global management through his work in the finance sector promoting business overseas, and also has extensive experience and broad insight into corporate governance as head of compliance divisions over many years. He was appointed as an Audit & Supervisory Board Member because it is expected that he can contribute to the enhancement of governance as the Group globalizes as well as perform accurate and fair monitoring and oversight functions for the execution of business by the Company's directors. |

| Yukio Ono | Mr. Ono is a licensed certified public accountant. His expertise and knowledge in the field of finance and accounting and many years of experience in corporate audit are beneficial to the Company in strengthening the audit system of the Company. Moreover, although he has not participated in corporate management in any manner other than as an external officer, he was appointed as an External Audit & Supervisory Board Member as he is considered to appropriately perform the duties of External Audit & Supervisory Board Member for the above credentials. |

| Akiko Yamakawa | Ms. Yamakawa is a licensed attorney and has extensive experience and knowledge regarding labor issues, including handling litigation regarding employment disputes at global corporations. In addition, through her external activities such as supporting women's participation in the workforce, she is expected to provide appropriate monitoring and supervision of the Company's global business execution and human resources strategies. Moreover, although she has not participated in corporate management in any manner other than as an external officer, she was appointed as an External Audit & Supervisory Board Member as she is considered to appropriately perform the duties of External Audit & Supervisory Board Member for the above credentials. |

| Hiroko Kudo | Ms. Kudo has deep insight into domestic and international administrative and financial affairs, a PhD in public policy, and is an active global figure as a university professor and researcher. Moreover, although she has not participated in corporate management in any manner other than as an external officer, she was appointed as an External Audit & Supervisory Board Member as it is considered that she will be able to utilize her extensive experience and knowledge to appropriately perform the duties of an Audit & Supervisory Board Member, thereby improving the value that DX provides to resolve social issues through the Company's business and deepening and expanding global management. |

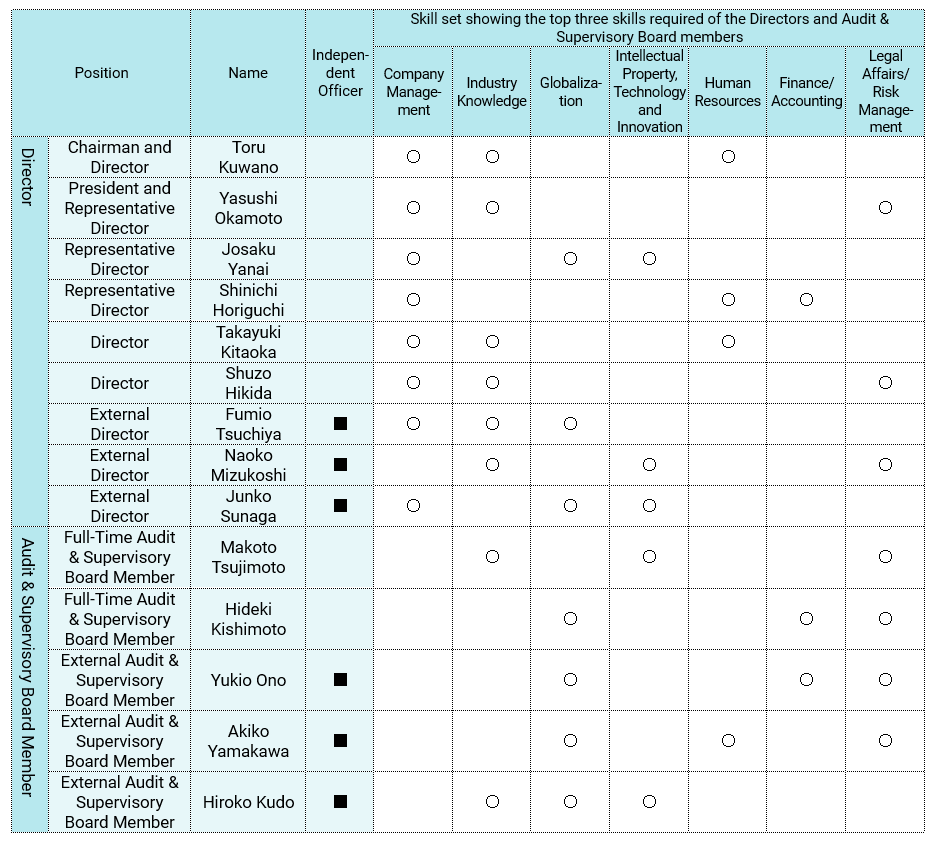

Board of Directors Skills Matrix

The Board of Directors needs to have a wide range of knowledge, experience and diversity in order to ensure the sustainable growth of the Company and increase its corporate value over the medium to long term. The experience, knowledge, skills, etc. that we consider to be particularly necessary have been set out below based on our materiality, GroupVision2032, and Medium-Term Management Plan 2024-2026.

| Skills Item | Skills Explanation |

|---|---|

| Company Management | Experience as a company representative director, or practical experience in evaluating important business opportunities and risks, making risk-taking decisions, and achieving business transformation as a manager with knowledge of corporate governance premised on sustainable management |

| Industry Knowledge | Cutting-edge knowledge of ICT and DX, as well as extensive knowledge and expertise in the information services industry and cybersecurity, all of which are necessary for promoting DX together with customers |

| Globalization | Practical experience in management of a company that operates globally, or practical experience in understanding the opportunities and risks of global business and engaging in business expansion overseas |

| Intellectual Property, Technology and Innovation | Expertise in intellectual property, which is essential for sustained improvement of corporate value, or practical experience and knowledge in driving innovation that brings prosperity to society through applied technology, and other such tools |

| Human Resources | Knowledge and practical experience to secure and promote the active participation of talented human resources capable of providing high added value, and to foster a work environment and corporate culture in which diverse human resources can work with motivation and peace of mind |

| Finance/Accounting | Possess knowledge of corporate finance necessary for medium- to long-term sustainable value creation, and practical experience in decision-making regarding investment and financial strategies |

| Legal Affairs/Risk Management | Expertise and practical experience in legal matters essential for the development of service businesses and global businesses, or knowledge of risk management necessary for a company to survive |

<Skills matrix>

Among the skills possessed by each member, the skills that are particularly expected

Profiles of our corporate officers are available here .

Training Policy for Directors and Auditors

For directors and auditors, including external directors and external auditors, the Company will provide and arrange training opportunities that are appropriate for individual directors and auditors and support the cost of such training. The objective of such training is to provide an opportunity to acquire necessary knowledge regarding the Group's businesses, financial affairs and organization and to understand the duties and responsibilities required of directors and auditors when assuming office, as well as to continuously update these attributes during the term of office.

External Directors and External Auditors

The Company has three external directors and three external auditors. The determination of the independence of external directors and external auditors is prescribed by the requirements of the Companies Act as well as judgement criteria to ensure the independence of external directors and external auditors (referred to as "external officers" hereafter) as described below, with reference to the rules and regulations of the Tokyo Stock Exchange.

For reference: Criteria Concerning Independence of External Officers (revised September 25, 2024)

The determination of the independence of external directors and external auditors is prescribed by the requirements of the Companies Act as well as judgement criteria to ensure the independence of external directors and external auditors (referred to as "external officers" hereafter) as described below, with reference to the rules and regulations of the Tokyo Stock Exchange.

- External directors (including candidates) are defined by Article 2, Paragraph 15 of the Companies Act (Requirements of External Directors) and have never served as an executive director, manager or other employee of the TIS INTEC Group (Note 1) even in the past.

- External auditors (including candidates) are defined by Article 2, Paragraph 16 of the Companies Act (Requirements of External Company Auditors) and have never served as a director, manager or other employee of the TIS INTEC Group even in the past.

- In the three most recent fiscal years, none of each of the following items shall apply to external officers.

- A counterparty which has transactions principally with the Company (Note 2) or a person who executes that counterparty's business

- A counterparty which has transactions principally with the TIS INTEC Group (Note 3) or a person who executes that counterparty's business

- A consultant, accounting professional or legal professional who has received a large amount of money or other assets (Note 4) other than remuneration of officers from the Company. In addition, when these are received by an organization such as a corporation or partnership, this includes persons who belong to the applicable organization.

- A major shareholder of the Company (Note 5). In addition, when the major shareholder is a corporation, this includes a person who executes the business of the corporation.

- A person other than those in (Ⅰ), (Ⅱ) and (Ⅲ) above who executes the business of a counterparty of the Company (Note 6)

- A person who was formerly a member of a counterparty which is in a situation of cross-assumption of offices of external officers

- A counterparty or former member of the counterparty that receives donations from the Company

- External officers must not be a relative within the second degree of a person who falls under each of the following items.

- A person mentioned in (Ⅰ) to (Ⅲ) of the previous clause

- A person who executes the business of a subsidiary of the Company

- A non-executive director of a subsidiary of the Company (limited to external auditors)

- A person who fell under (Ⅱ) or (Ⅲ) above or a person who executes the business of the Company (including a non-executive director in the case of an external auditor) recently (in the current and during the past four business years)

- In addition to the above, there exist no circumstances in which duties imposed on an independent external officer are reasonably deemed not to be achieved.

- Note 1: The "TIS INTEC Group" means the Company and its subsidiaries.

- Note 2: A "counterparty which has transactions principally with the Company" means a counterparty which provides products or services to the Company and whose payments from the Company constitute at least 2% of the sales of such counterpart in one fiscal year. The main bank (MUFG Bank, Ltd.) and the lead managing underwriters (Nomura Securities Co., Ltd., Mitsubishi UFJ Morgan Stanley Securities Co, Ltd., and SMBC Nikko Securities Inc.) of the Company shall also each be a "counterpart which has transactions principally with the Company," regardless of the transaction amount.

- Note 3: A "counterparty which has transactions principally with the TIS INTEC Group" means a counterparty with sales exceeding 2% of the total consolidated sales of the TIS INTEC Group.

- Note 4: "A large amount of money or other assets" means the total value exceeds 10 million yen per fiscal year.

- Note 5: A "major shareholder" means a person or company, and the like, that directly or indirectly holds 10% or more of total voting rights. However, the Company's leading shareholders (the top 10 approximately) shall be treated as "major shareholders."

- Note 6: A "counterparty which has transactions with the Company" means the case when transactions with the Company per fiscal year constitute at least 2% of non-consolidated sales of the Company.

Primary Activities of External Directors and External Auditors (Year ended March 31, 2025)

| Status | Name | Primary Activities |

|---|---|---|

| Director | Fumio Tsuchiya | Mr.Tsuchiya attended all 17 meetings of the Board of Directors, which were held during the fiscal year under review, and provided advice and recommendations to ensure validity and appropriateness of decision-making of the Board of Directors based on his abundant experience and insight in corporate management. Also, he has served as a member of the Nomination Committee and the Remuneration Committee, which are voluntary advisory bodies to the Board of Directors, and has served as chairperson of the respective committee until June 25, 2024, attending all 8 meetings of the Nomination Committee and all 4 meetings of the Remuneration Committee held during the fiscal year under review, and playing an important role upon reporting to the Board of Directors in response to the inquires of the Board of Directors about nomination and remuneration of Directors, etc. |

| Director | Naoko Mizukoshi | Ms. Mizukoshi attended 16 out of the 17 meetings of the Board of Directors, which were held during the fiscal year under review, and provided advice and recommendations to ensure validity and appropriateness of decision-making of the Board of Directors from her professional viewpoint as a lawyer. Also, she has served as chairperson of the Nomination Committee and the Remuneration Committee, which are voluntary advisory bodies to the Board of Directors, since June 25, 2024, attending all 8 meetings of the Nomination Committee and all 4 meetings of the Remuneration Committee held during the fiscal year under review, and playing an important role upon summarizing opinions and reporting to the Board of Directors in response to the inquires of the Board of Directors about nomination and remuneration of Directors, etc. |

| Director | Junko Sunaga | Ms. Sunaga attended all 11 meetings of the Board of Directors, which were held after her appointment on June 25, 2024, and provided advice and recommendations to ensure validity and appropriateness of decision-making of the Board of Directors based on her abundant experience and insight in corporate management. Also, she has served as a member of the Nomination Committee and the Remuneration Committee, which are voluntary advisory bodies to the Board of Directors, attending all 6 meetings of the Nomination Committee and both of the 2 meetings of the Remuneration Committee held since her appointment on June 25, 2024, and playing an important role upon reporting to the Board of Directors in response to the inquires of the Board of Directors about nomination and remuneration of Directors, etc. |

| Auditor | Yukio Ono | Mr. Ono attended 16 out of the 17 meetings of the Board of Directors and all 13 meetings of the Audit & Supervisory Board, each of which were held during the fiscal year under review, and provided recommendations to ensure appropriateness of decision-making of the Board of Directors from his professional viewpoint as a certified public accountant. Also, he made the necessary remarks as appropriate at meetings of the Audit & Supervisory Board. |

| Auditor | Akiko Yamakawa | Ms. Yamakawa attended all 17 meetings of the Board of Directors and all 13 meetings of the Audit & Supervisory Board, each of which were held during the fiscal year under review, and provided recommendations to ensure appropriateness of decision-making of the Board of Directors from her professional viewpoint as a lawyer. Also, in addition to making the necessary remarks as appropriate at meetings of the Audit & Supervisory Board, she has served as a member of the Nomination Committee and the Remuneration Committee, which are voluntary advisory bodies to the Board of Directors, attending all 8 meetings of the Nomination Committee and all 4 meetings of the Remuneration Committee held while she was in office during the fiscal year under review, and playing an important role upon reporting to the Board of Directors in response to the inquires of the Board of Directors about nomination and remuneration of Directors, etc. |

| Auditor | Hiroko Kudo | Ms. Kudo attended all 17 meetings of the Board of Directors and 12 out of the 13 meetings of the Audit & Supervisory Board, each of which were held during the fiscal year under review, and provided recommendations to ensure appropriateness of decision-making of the Board of Directors with her high level of knowledge and insight as an academic expert. Also, she made the necessary remarks as appropriate at meetings of the Audit & Supervisory Board. |

Note:In addition to the above-mentioned number of meetings of the Board of Directors that were held, we have made two written resolutions deemed to have been made by the Board of Directors based on the provisions of Article 370 of the Companies Act and Article 27 of the Articles of Incorporation.

Summary of Content of Liability Agreements

In accordance with Article 427, Paragraph 1 of the Companies Act, each of Audit & Supervisory Board enters into an agreement with the Company that limits legal responsibility for liability compensation as set forth under Article 423, Paragraph 1 of the same law.

The limit of liability compensation, based on these agreements, is an amount provided for in Article 425, Paragraph 1, of the same law.

Overview of the contents of the indemnity agreement, etc.

The Company has concluded an indemnity agreement as stipulated in Article 430-2, Paragraph 1 of the Companies Act with Directors and Audit & Supervisory Board Members. The Company will provide indemnification for expenses described in Article 430-2, Paragraph 1, item (i) of the Companies Act and losses described in item (ii) of the same, within the scope prescribed in laws and regulations. Certain measures, however, have been taken to ensure that this indemnity agreement does not impair the proper execution of duties of officers of the Company, such as excluding officers from eligibility for indemnification if the relevant duties were performed in bad faith or with gross negligence, and if the Company enforces the liability of officers.

Overview of the contents of the officers’ liability insurance contract

The Company has concluded an officer liability insurance contract as stipulated in Article 430-3, Paragraph 1 of the Companies Act with an insurance company as follows:

1. Scope of the insured

- (1) Directors, audit & supervisory board members and executive officers of the Company and consolidated subsidiaries of the Company

- (2) Executive officers and employees who are dispatched to or concurrently serving at overseas subsidiaries and overseas investment companies of the Company

2. Overview of the contents of the insurance contract

In the event of a claim for damages due to an action (including in-action) by the insured as part of their duties as officers of the company, that falls under (1), damages including compensation for damages and legal expenses to be borne by the insured shall be compensated for under the said insurance agreement. However, damages, etc., incurred by officers themselves who have conducted a criminal act such as bribery and/or intentionally conducted an illegal act are not subject to compensation. This way, measures are taken to ensure that the appropriateness of the execution of duties by officers, etc. is not impaired.

The Company bears the full amount of insurance premiums including the rider portion, and there are no substantial premiums borne by the insured.

Overview of the policies for determination of remuneration, etc.

1. Remuneration determination policies

In order to ensure objectivity and transparency of the remuneration determination process and further strengthen the corporate governance framework, the Company has set up an arbitrary remuneration committee consisting mainly of Independent External Directors as an advisory body to the Board of Directors.

Officers' remuneration is determined by the resolution of the Board of Directors after consulting and reporting to the Remuneration Committee with the basic policy of strengthening incentives to improve performance by implementing a remuneration system linked to the company performance indicators.

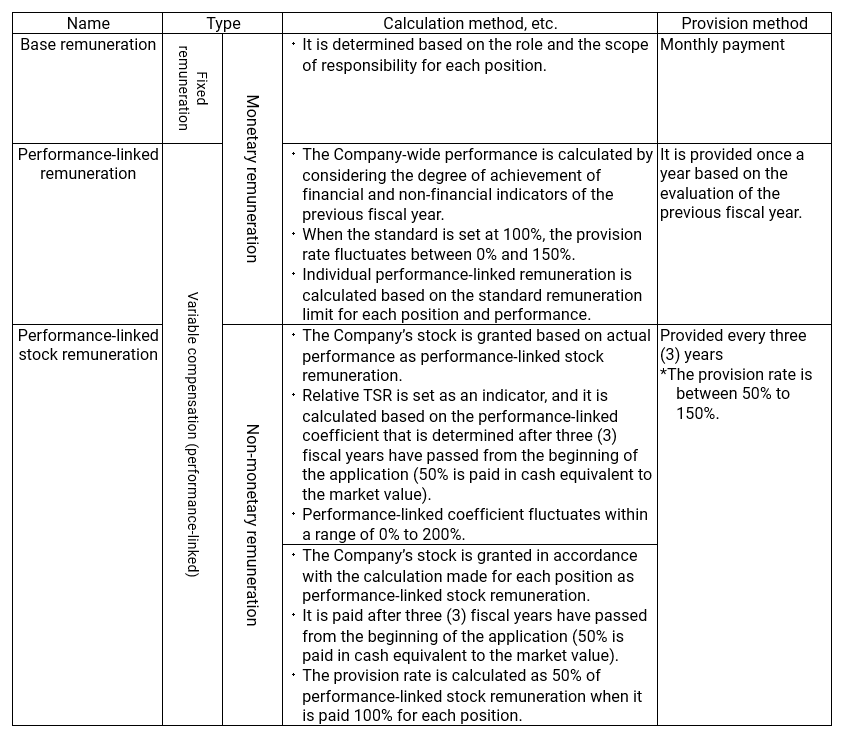

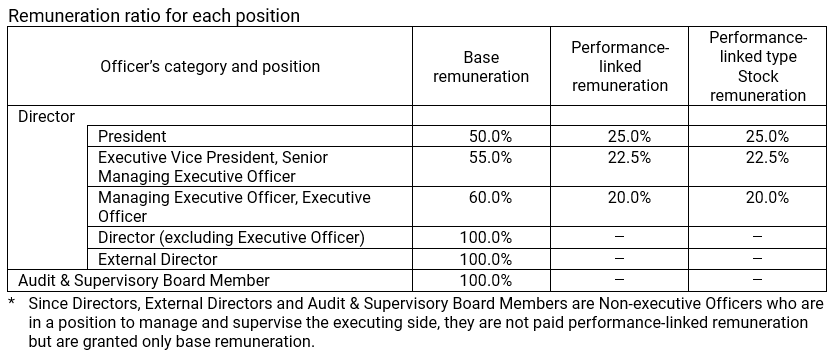

2. Remuneration structure for officers

The Company's remuneration system consists of base remuneration, performance-linked remuneration and performance-linked stock remuneration. Each remuneration's type, calculation method and provision method are as follows.

3. Remuneration structure for External Directors and Audit & Supervisory Board Members

The remuneration for External Directors consists of only base remuneration without performance-linked remuneration paid.

Also, remuneration for Audit & Supervisory Board Members is determined through discussions among Audit & Supervisory Board Members. Only base remuneration is paid without linking to performance from the perspective of ensuring a high degree of independence.

4. Other

When the performance-linked stock remuneration system was introduced, the Board of Directors resolved to stipulate activities that are not complying with the stock delivery regulations and a clause that makes it possible to request that a person who has violated the regulations returns the amount equivalent to the delivered shares, etc. and a clause that makes it possible to confiscate the awarded points.

5. Process to determine officers’ remuneration

- (1) Based on the medium-term management plan, evaluate the results including the status of achievement of the business plans drawn up at the beginning of the fiscal year at a performance evaluation meeting to be held in late May, every year.

- (2) At the performance evaluation meeting mentioned in (1) above, the President and Representative Director evaluates officers.

- (3) Consult on the evaluation result of (2) above and the amount of remuneration based on the evaluation result at the Remuneration Committee to be held in mid-June each year.

- (4) The Board of Directors shall resolve the amount of remuneration for officers, which has been mentioned to and discussed with the Remuneration Committee mentioned in (3) above.

- (5) Among the annual amount of officers' remuneration, which has been resolved at the meeting of the Board of Directors as described in (4) above, base remuneration is paid monthly while performance-linked remuneration is paid in one lump sum in July.

- (6) As for the level of the amount of officers' remuneration, we ask a third-party organization to conduct a survey on officers' remuneration to analyze trends of other companies from July each year.

- (7) We report the result of the officers' remuneration survey conducted by the third-party in (6) above to the Remuneration Committee in November each year to inquire about a revision of the amount of officers' remuneration.

Performance-linked stock remuneration is calculated based on the stock delivery regulations, and there is no room for discretion of the Representative Director or the Remuneration Committee.

6. Activities of the Advisory Committee with respect to determination of officers’ remuneration

A total of four Remuneration Committee meetings were held in the fiscal year ended March 31, 2025, to inquire about the validity of the remuneration of the Company based on comparative analysis between the officers' remuneration amount of the Company and the officers' remuneration of other companies, which had been made by the research company. The Board of Directors put a proposal on officers' remuneration on the agenda based on the result of the advice given by the relevant organization.

7. Method of calculating remuneration

The calculation methods for the base remuneration, performance-linked remuneration and performance-linked stock remuneration shown in 2. are as follows:

(1) Base remuneration

Paid based on the magnitude of the role and the scope of responsibility for each position.

(2) Performance-linked remuneration

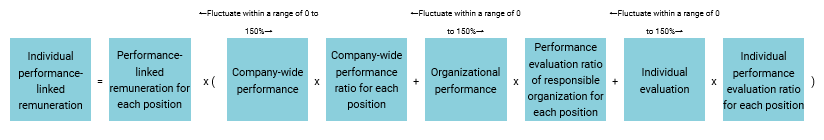

For the calculation of performance-linked remuneration, a provision rate is calculated based on company-wide performance, the performance of the responsible organization and individual appraisal. Then, a performance evaluation ratio for each position is added to the calculated provision rate. The delivered rate is used for the calculating individual payments (0% to 150%). The specific calculation method is as follows:

Performance-linked remuneration assessment item

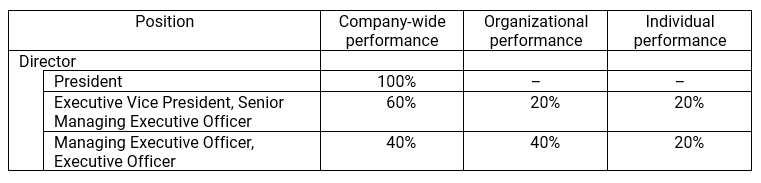

(i) Allocation ratio of performance evaluation for each position

The amount of individual performance-linked remuneration is calculated by determining an allocation ratio of performance evaluation for each position as follows, and calculating an evaluation score for company-wide performance, the performance of the responsible organization and individual appraisal separately.

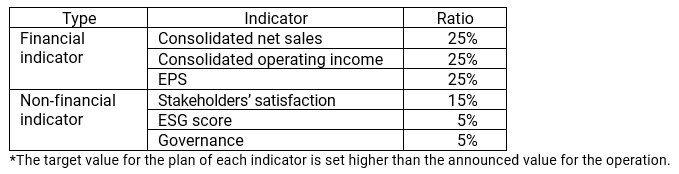

(ii) Determination of company-wide performance evaluation score

1) Company-wide performance indicator and evaluation ratio

Company-wide performance evaluation is determined with the degree of achievement of the plan for each indicator and each indicator's ratio.

A company-wide performance score is calculated based on the company-wide performance score formula in 2).

2) Company-wide performance evaluation score formula

A company-wide performance evaluation score is determined using the formula below based on the degree of achievement of the target value for each company-wide performance indicator and each indicator's ratio.

Company-wide performance evaluation score = Σ (Degree of achievement of each financial indicator × each ratio) + Σ (Degree of achievement of each non-financial indicator × each ratio)

*The upper limit is 150% if it exceeds 150%.

(iii) Determination of organizational performance evaluation score

Organizational performance is calculated within a range of 0 to 100 points based on the degree of achievement of financial and non-financial indicators for the officer's responsible organization during the target fiscal year for the performance evaluation. The calculated organizational performance evaluation score is divided by the base score of 66.5 points so that it falls within a range of 0% to 150%, and the evaluation score is determined within a range of 0% to 150%.

Organizational performance evaluation score = Performance evaluation of responsible organization/base score

*The upper limit is 150% if it exceeds 150%.

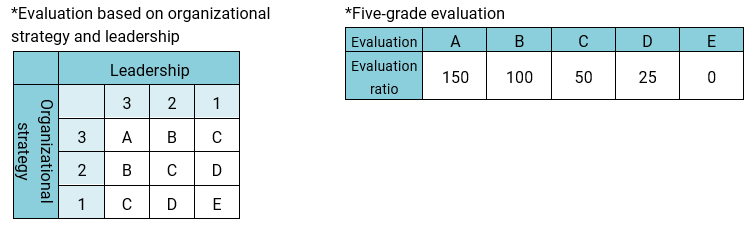

(iv) Determination of individual performance evaluation score

An individual performance evaluation score is delivered as a final five-grade evaluation based on the two-axis evaluation assessing the progress of the strategies developed as targets by an eligible officer for his/her responsible organization in the previous fiscal year (three-grade evaluation) and the degree of leadership demonstrated (three-grade evaluation) by the officer.

(v) Formula for individual performance-linked remuneration

(i) Allocation ratio of performance evaluation for each position, (ii) Company-wide performance, (iii) Organizational performance and (iv) Individual performance described above are separately evaluated. The amount of remuneration is determined with the following formula.

(3) Performance-linked stock remuneration

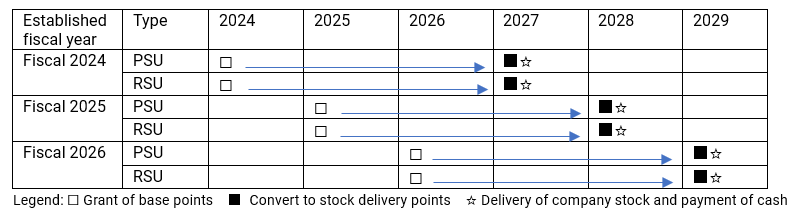

Performance-linked stock remuneration is a system that provides non-monetary remuneration (hereinafter referred to as the "System"). The Company establishes an incentive plan that covers consecutive three (3) fiscal years (hereinafter referred to as the "Assessment Period") as the consideration for executing duties during the target job execution period. Under the System set in fiscal 2024, the Company grants officers who are eligible for the System (hereinafter referred to as "Eligible Officers") 50% each of the base points defined for each position as a performance-linked part (PSU) and fixed part (RSU) during the Assessment Period of the three (3) consecutive fiscal years from fiscal 2024 to fiscal 2026. As a general rule, in July, after the completion of the Assessment Period, for people who satisfy certain requirements, the number of base points is converted into stock delivery points based on the formula for performance-linked stock remuneration for each person, and the Company's common stock is provided in accordance with the total number of the stock delivery points.

(1 point = 1 share)

About 50% of the Company stock is sold on the stock market to secure the funds to pay taxes and the proceeds of the sales is paid.

- PSU (Performance Share Unit) is the Company's common stock provided after three (3) fiscal years have passed from the beginning of the application to Eligible Officers who belong to the Company as of April 1 of the initial fiscal year of the application based on the growth rate of the Company's stock price during the Assessment Period. (50% is paid in cash equivalent to the market price.)

- RSU (Restricted Share Unit) system is introduced in fiscal 2024 and allows the Company to grant Eligible Officers who belong to the Company as of April 1 of the initial fiscal year of the application a fixed number of the Company's common stock after three (3) fiscal years have passed from the beginning of the application. (50% is paid in cash equivalent to the market price.)

(i) Performance evaluation period (model period from 2024 to 2026)

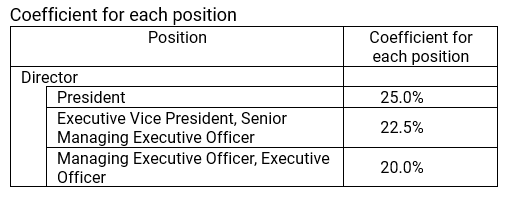

(ii) Calculation of base amount for each position

Base amount used to grant points is set for each position as follows:

Base amount for each position = Base remuneration for each position × Coefficient for each position

(iii) Method of calculating point (1 point = 1 share)

1) PSU:

- At the beginning of fiscal year

Number of base points (PSU) =

Base amount for each position × 50% / The Company's stock price at the time of acquisition (figures below the decimal point are omitted) - At the time of performance evaluation (at the time of granting stock)

Number of stock delivery points (PSU) =

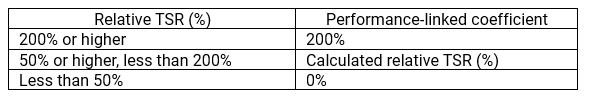

Number of base points (PSU) = Number of months of service / 12 months × Performance-linked coefficient (figures below 1 point are omitted) - Performance-linked coefficient

The performance-linked coefficient applied at the time of the performance evaluation (at the time of granting stock) is determined based on relative TSR as follows:

2) RSU:

- At the beginning of fiscal year

Number of base points (RSU)

= Base amount for each position × 50% / The Company's stock price at the time of acquisition (figures below the decimal point are omitted) - At the time of share delivery

Number of stock delivery points (RSU)

= Number of base points (RSU) = Number of months of service/12 months × Performance-linked coefficient (figures below 1 point are omitted)

3) Number of stock delivery points:

Number of stock delivery points

= Number of stock delivery points (PSU) + Number of stock delivery points (RSU)

(iv) Calculation method of relative TSR (%) (As an example for the explanation, the case of fiscal 2024 is shown.)

Relative TSR (%) = The Company's RSR (%) / TOPIX growth rate (%)

The Company's RSR (%) = (B + C) / A

A: Average closing price of the Company's stock on the Tokyo Stock Exchange in May 2024

B: Average closing price of the Company's stock on the Tokyo Stock Exchange in May 2027

C: Total amount of dividend per share of the Company's stock from the beginning of fiscal 2024 to the end of fiscal 2026

TOPIX growth rate (%) = E / D

D: Average closing price of TOPIX on the Tokyo Stock Exchange in May 2024

E: Average closing price of TOPIX on the Tokyo Stock Exchange in May 2027

Remuneration for Directors and Audit & Supervisory Board Members (Year ended March 31, 2025)

|

|

Recipients (Persons) |

Remuneration (Millions of yen) |

Remuneration by type | ||

|---|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration | Performance-linked Stock compensation |

|||

| Directors (External Directors) |

10 (4) |

439 (32) |

247 (32) |

108 (-) |

83 (-) |

| Audit & Supervisory Board Members (External Auditors) |

6 (3) |

57 (28) |

57 (28) |

- (-) |

- (-) |

| Total (External Directors and External Auditors) |

16 (7) |

496 (61) |

304 (61) |

108 (-) |

83 (-) |

Notes

- There is no employee portion of salaries for Directors who concurrently serve as employees for the fiscal year under review. Also, no bonuses were paid because the Company has not implemented an Officer retirement benefit system.

- As of the end of the fiscal year under review, there are nine (9) Directors (including three (3) External Directors) and five (5) Audit & Supervisory Board Members (including three (3) External Audit & Supervisory Board Members). It is different from the above-mentioned number of Directors and Audit & Supervisory Board Members because it includes one (1) Director and one (1) Audit & Supervisory Board Member who retired at the conclusion of the 16th Annual General Meeting of Shareholders, which was held on June 25, 2024.

- It has been resolved at the 16th Annual General Meeting of Shareholders, which was held on June 25, 2024, that the amount of remuneration for Directors and Audit & Supervisory Board Members (base remuneration and performance-linked remuneration) shall be 800 million yen or less per year (of which, 100 million yen or less for External Directors) and 150 million yen or less per year for Audit & Supervisory Board Members. At the conclusion of the relevant General Meeting of Shareholders, there are nine (9) Directors (including three (3) External Directors) and five (5) Audit & Supervisory Board Members (including three (3) External Audit & Supervisory Board Members).

- As for performance-linked remuneration, a revised officers' remuneration system was introduced in July 2024 and the amount paid includes performance-linked remuneration based on the previous officers' remuneration system.

- Performance-linked stock remuneration is the amount of expenses recorded during the fiscal year under review for three (3) Directors (excluding External Directors, part-time Directors, and non-residents of Japan).

The relevant performance-linked stock remuneration was introduced with Directors (four (4) persons excluding External Directors and part-time Directors), Executive Officers, and Executive Fellows as eligible persons at the 10th Annual General Meeting of Shareholders held on June 26, 2018. At the 13th Annual General Meeting of Shareholders held on June 24, 2021, partial revisions were made such as adding Directors (excluding External Directors and part-time Directors) and Executive Officers of INTEC Inc., a subsidiary of the Company, as eligible persons. In addition, it was resolved at the 16th Annual General Meeting of Shareholders, which was held on June 25, 2024, to make partial revisions such as limiting the eligible persons to Directors and Executive Officers (excluding non-executive Directors and those who do not reside in Japan), and Directors and Executive Officers (excluding non-executive Directors and those who do not reside in Japan) of INTEC Inc., a subsidiary of the Company, as well as that the number of shares of the Company to be delivered through the trust shall be limited to 230,000 shares per fiscal year (including 200,000 shares for the Company) by contributing a maximum of 1,810 million yen (including 1,630 million yen for the Company) to the relevant trust for each target period (three fiscal years), with the number of Directors (executive Directors) at the time of resolution of said General Meeting of Shareholders standing at three (3).

Constructive Dialogue with Shareholders

TIS will actively engage in constructive dialogue with shareholders based on the IR Policy in order to contribute to the Company's sustainable growth and the enhancement of its medium- to long-term corporate value. In addition, the Company will strive to develop a system to promote constructive dialogue with shareholders.

In the case of dialogue with shareholders, TIS will pay sufficient attention to the fairness of information disclosure and manage internal information appropriately in accordance with the Rules for Prevention of Insider Trading

Status of Dialogue with Shareholders

In fiscal 2024, ended March 31, 2024, TIS energetically promoted constructive dialogue, led by the president, with shareholders in Japan and overseas (mainly in the United States, Europe and Asia) engaged in active management. The attributes of active management are diverse, centered on growth and value, and analysts and fund managers were the main shareholders involved in dialogue opportunities. TIS also engaged with people responsible for exercising voting rights.

Main dialogue themes and matters of interest to shareholders (see below) were shared and discussed within the Company through quarterly reports and feedback to the Board of Directors and utilized in reviewing management strategies and formulating medium-term management plans.

Main dialogue themes and matters of interest to shareholders

- Status of structural transformation aimed at growing business and improving profitability, and future prospects

- Update on review of business portfolio

- Importance of investing in human resources, the Company's most important management capital, and response measures

- Status of initiatives for ESG centered on human resources

- Approach to cash allocation for improving corporate value (growth investments and shareholder returns)

- Financial strategies and metrics, such as key performance indicators (KPIs), with capital efficiency in mind

| IR Events in Fiscal 2024 | Frequency | Notes |

|---|---|---|

| Results briefings for analysts and institutional investors | 4 times |

|

| Other briefings for analysts and institutional investors | 1 time | Business briefings: 1 time |

| Small meetings for analysts and institutional investors | 228 times | Of which overseas investors participated: 111 times Total number of participating investors: 440 companies |

| Small meetings by President | 3 times | sell-side analysts: 1 time, buy-side analysts: 2 times. |

| Overseas roadshows | 2 times | North America, Europe |

| Conference | 3 times | Domestic: 2 times Overseas (Asia): 1 time |

| IR conferences for individual investors | 2 times |

|

* Conducted in person or online, taking each situation and other factors into account.

Cross-shareholdings

1. Policies for cross-holdings of shares

In accordance with the basic corporate governance policies set by the Company, the Company will not, in principle, make any new acquisitions of domestic listed shares, and works to reduce domestic listed shares as much as possible by positioning it as a priority issue. On the other hand, only if it is judged that it will contribute to the sustainable growth of the Group as well as the enhancement of its medium- to long-term corporate value, shares of unlisted companies, including start-up and venture companies may be strategically held. Specifically, in order to proactively promote business deployment focusing on the social issues to be resolved, which the Company has selected to contribute to the realization of a sustainable society, including “financial inclusion,” “concentration in cities/decline in rural areas” and “health issues,” collaboration and co-creation activity with those companies and stable alliance and cooperative relationships may be essential for continuous creation of business opportunities and utilization of technologies. We position share holdings for that case as an investment that meets the growth strategy of the Group, and define them as “strategically held shares.”

Upon verifying the rationality of continuing to hold shares, we classify shares held into the following two categories and set a verification method for each of them.

Capital alliance partners

After making an investment, the Company will continue to hold the shares for a certain period of time determined by the Company as a period to establish the foundation of the strategic alliance.

After a certain period of time has passed, we will verify to check the progress status of the collaborative business and to see whether or not there are ongoing transactions through qualitative evaluation. As a result of the verification, if it is judged that there is little significance in holding them, listed shares will be sold based on the market conditions, etc. and unlisted shares will be sold as soon as a buyer is found in consultation with the issuer.

Others (items not covered by the above)

We will calculate the percentage of the total amount of the business-related revenue and dividends from each issuer and its affiliated companies against the amount of shares of each stock held as cross-shareholdings, which is recorded on the balance sheet to check to see whether or not it exceeds 10%. As a result of the verification, also considering the qualitative evaluation such as future transaction prospects, if it is judged that there is little significance in holding them, listed shares will be sold based on the market conditions, etc. and unlisted shares will be sold as soon as a buyer is found in consultation with the issuer.

Also, while proceeding with reduction in line with the above-mentioned policies and concepts, we aim to lower the percentage of the amount of the cross-shareholding shares recorded on the balance sheet against the consolidated net assets to the 10% level. To achieve this goal, we reduced 13 issues of shares held for cross-holdings including 9 issues sold in full. Due to fluctuations in the market value in the stock market in addition to the above-mentioned reduction, the amount recorded on the balance sheet for the fiscal year ended March 31, 2025 decreased by 3.6 billion yen to 23.1 billion yen. As a result, the above-mentioned percentage in the fiscal year ended March 31, 2025, is 6.5% (down 1.7 percentage points year on year), and the percentage excluding strategically held shares is 2.3%.

2. Criteria for exercising voting rights for cross-shareholdings

We will exercise voting rights for listed shares held properly after comprehensively judging whether or not it will contribute to the sustainable growth of the Group and the investees as well as the enhancement of their medium- to long-term corporate value among others also while considering the proxy advisory policies of proxy advisory firms.

3. Number of issues held by the Company for purposes other than portfolio investment and total amounts recorded on the balance sheet

| Category | Fiscal 2024, ended March 31, 2024 | Fiscal 2025, ended March 31, 2025 | ||

|---|---|---|---|---|

| Number of issues | total | 79 issues | 79 issues | |

| (of which) | Strategic shareholdings | 59 issues | 61 issues | |

| Cross-shareholdings | 20 issues | 18 issues | ||

| Total balance-sheet amount | total | 26,774 million yen | 23,140 million yen | |

| (of which) | Strategic shareholdings | 17,700 million yen | 14,998 million yen | |

| Cross-shareholdings | 9,073 million yen | 8,141 million yen | ||

Note: During the fiscal year under review, for the purpose of strategic collaboration to promote open innovation, etc., we newly acquired shares of 9 capital alliance partner companies including a venture company (2,193 million yen).

4. Relationships with strategic shareholders

If strategic shareholders of TIS indicate an intention regarding the sale, etc. of TIS shares, we will respond appropriately without preventing such a sale. Moreover, we will not conduct transactions that lack economic rationality with strategic shareholders.

Takeover Defense Measures

TIS has not introduced takeover defense measures.